Is the Earnings Rally Losing Steam?

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.

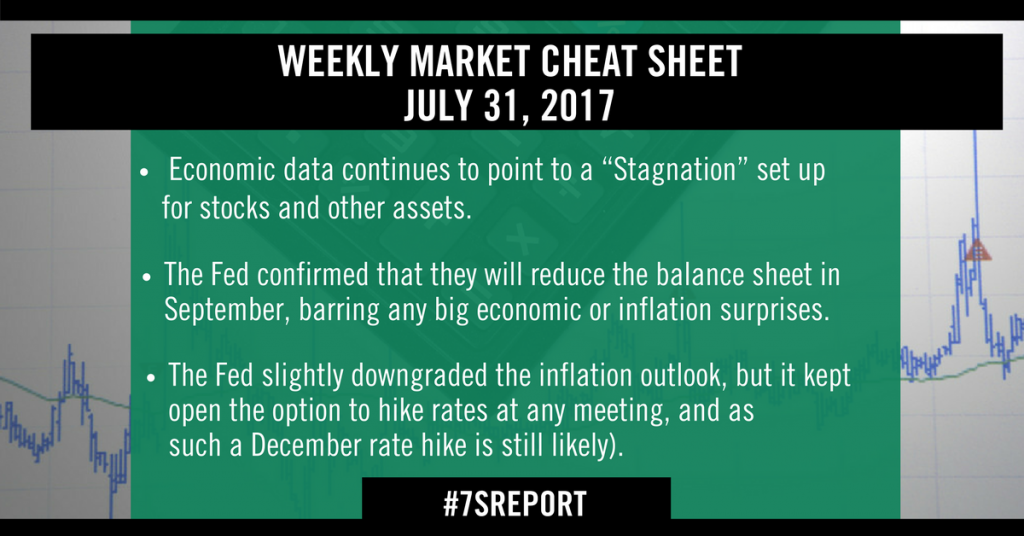

Earnings have been an unsung hero of the 2017 rally, but there are some anecdotal signs that strong earnings may already be fully priced into stocks, leaving a lack of potential positive catalysts given the macro environment.

Now, to be clear, earnings season has been (on the surface) good. From a broad standpoint, the results have pushed expected 2018 S&P 500 EPS slightly higher (to $139) and that’s enough to justify current valuations, taken in the context of a calm macro horizon and still-low bond yields.

However, the market’s reaction to strong earnings is sending some caution signals throughout the investor

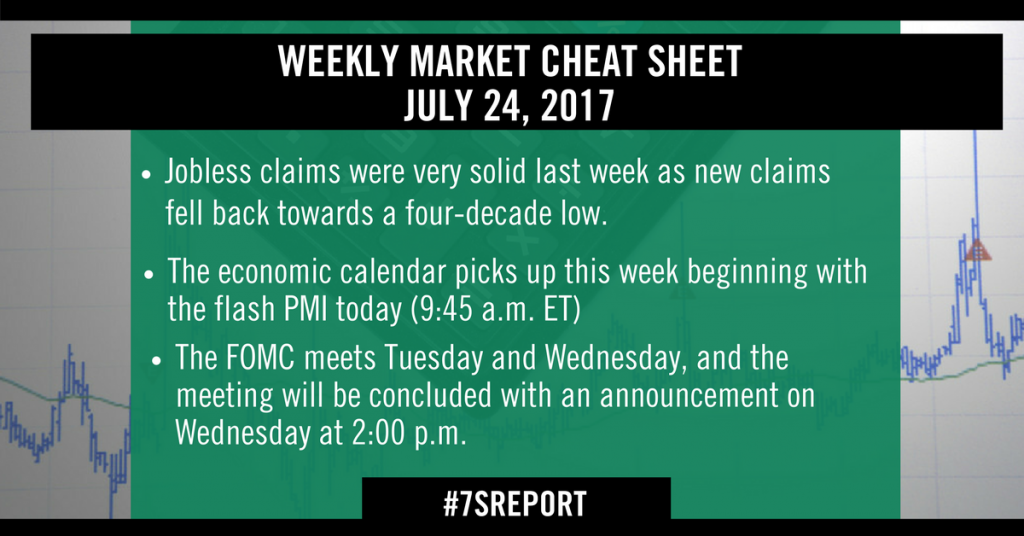

community. Specifically, according to a BAML report I read earlier this week, the vast majority of companies who reported a beat on the top line (revenues) and bottom line (earnings) saw virtually no post-earnings rally this quarter. Getting specific, by the published date of the report (earlier this week) 174 S&P 500 companies had beat on the top and bottom line, yet the average gain for those stocks 24 hours after the announcement was… 0%. They were flat. To boot, five days after the results, on average these 174 companies had underperformed the market!

That’s in stark contrast to the 1.6%, 24-hour gain that companies who beat on the revenues and earnings have enjoyed, on average, since 2000.

In fact, the last time we saw this type of post earnings/sales beat non-reaction was Q2 of 2000. It could be random, but that’s not exactly the best reference point.

So, if we’re facing a market that’s fully priced in strong earnings, the important question then becomes, what will spur even more earnings growth?

Potential answers are: 1) A rising tide of economic activity, although that’s not currently happening. Another is 2) A surge in productivity that increases the bottom line. But, productivity growth has been elusive for nearly a decade, and it’s unclear what would suddenly spark a revival. Finally, another candidate is 3) Rising inflation that would allow for price and margin increases. Yet as we know, that’s not exactly threatening right now, either.

Bottom line, earnings have been the unsung hero of this market throughout 2017, but this is a, “What Have You Don’t For Me Lately” market, especially at nearly 18X next year’s earnings. If earnings growth begins to slow and we don’t get any uptick in economic growth or pro-growth policies from Washington, then it’s hard to see what will push this market higher beyond just general momentum (and general momentum may be fading, at least according to the price action in tech). To be clear, the trend in stocks is still higher, but the environment isn’t as benign as sentiment, the VIX or the financial media would have you believe.

Time is money. Spend more time making money and less time researching markets every day—start your free trial of the Sevens Report now.

te Hikes in 2017)

te Hikes in 2017) Auto sales fell to 17.0M saar vs. (E) 17.2M saar, and that number joins a growing chorus of caution signs on the auto industry, including fears about used car pricing and used car debt.

Auto sales fell to 17.0M saar vs. (E) 17.2M saar, and that number joins a growing chorus of caution signs on the auto industry, including fears about used car pricing and used car debt.