Stock Market Update from The Sevens Report: Stocks declined for the first time in 2017, but the losses were small, as disappointing retailer earnings offset more decent economic data ahead of the first big catalyst of the year… the December jobs report. The S&P 500 declined 0.08%.

Stocks were flat at the start of Thursday trade, as very poor results from KSS and M offset more decent global economic data. US data yesterday was mixed, but generally “fine,” as jobless claims dropped sharply (ADP missed estimates, but not terribly so) and ISM Non-Manufacturing PMI slightly beat estimates. In total, none of the data points altered the narrative around the economy or Fed expectations, and stocks opened flat and chopped sideways with small gains until the oil inventory number.

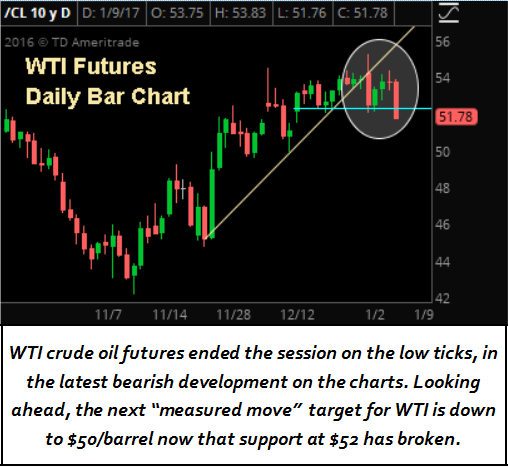

The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.

The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.

Stock Market Update: Trading Color

From a sector standpoint it was quiet outside of financials and retailers (more on those in a second). No SPDR we track moved more than 0.50% yesterday, and trading was mixed excluding financials. Three of the SPDRs we track traded higher (led by healthcare (XLV +0.45%) while five SPDRs were lower (led by industrials, XLI -0.30%). There was no notable news that caused the moves in these sectors, and most of it was just general positioning.

The same cannot be said for financials and retailers, as banks dropped 1.7% and financials fell 1.2% on the drop in bond yields, as the 30-year Treasury yield hit a one-month low.

Retail, meanwhile, got hammered courtesy of KSS and M, which plunged 19% and 14%, respectively. That dragged down XRT, the retail ETF (-2.4%). Notably, though, the broad consumer discretionary SPDR, XLY, declined only 0.11%, and that reinforces what I said earlier Wednesday that the KSS and M prints are a retail business model problem (i.e. too much brick and mortar, not enough online) not a consumer spending problem (and that’s a positive for the economy broadly). The traditional retail sector continues to face stiff structural headwinds, and I’m not interested in buying dips.

Finally, looking at tech, semiconductors continued to fall but they held support at 900 in the SOX. A break of that makes me short-term nervous on stocks. Meanwhile, our old friends the FANGs (FB/AMZN/NFLX/GOOGL) all traded well and FDN rose 1.1%. While not as powerful as they were in 2015, owning super-cap internet stocks continues to make sense for longer-term investors, as those companies continue to be on the edge of innovation in tech.

Looking ahead to today, the risk here is for a soft jobs report due to ADP and if the report but unless the S&P 500 breaks support at 2239 the short term trend remains higher.

Why Chinese Yuan Volatility Matters to You

One of the more important, but underfollowed, stories in the financial media this week has been the surge higher in the Chinese yuan. That move caused the dollar drop yesterday, and it’s an uncomfortable reminder of yuan-inspired stock volatility in January 2016.

Understanding yuan trading dynamics is about as exciting as reading stereo instructions (and in some cases just as complicated), so I’m not going to bore you with the details. But, it is important you understand 1) What’s happening with the yuan, 2) Why it’s a risk to stocks and 3) How to hedge against a yuan-inspired decline in stocks.

What Happened: Since the election, the yuan weakened relentlessly vs. the dollar. And as we started 2017, it was in danger of breaking the psychologically important $7.00 level. A break of that level is a problem for two reasons. First, it would provide fodder for China hardliners in the Trump administration to get tough on trade, because the currency would be so weak. Second, it would put stress on China’s ability to control the yuan, as a break of the level would invite more selling of the yuan.

So, to support the yuan, Chinese authorities intervened in the markets starting on Wednesday, and continued on Thursday, and the results were significant—the yuan surged nearly 2% in two days, the biggest two-day move since 2010.

Why It Matters: There have been two periods in the last two years where we’ve seen this level of yuan volatility: Aug/Sept ’15 and Jan ’16. Both periods saw deep, sharp and scary stock market pullbacks, because the yuan gyrations caused a loss of confidence in the Chinese economy/authorities. Fearing a Chinese “hard landing,” global investors sold first and asked questions later.

Today, the causes of yuan volatility are different, and I don’t think we’re on the precipice of a yuan-inspired pullback in stocks just yet. But, the chances are rising.

The reason why is the yuan declines aren’t over. That’s because the decline in the yuan is a product of 1) Fears of trade disputes with a Trump administration hurting the Chinese economy and 2) A relentlessly rallying dollar, which will force the yuan lower and risk a recession in China.

Everyone knows both these longer-term trends (higher dollar/weaker yuan), which is why Chinese citizens are trying to exchange yuan for dollars or other currencies. And it’s why the Chinese government has imposed capital controls preventing citizens and companies from doing just that!

Near term, Chinese authorities can support the yuan and continue to defend the $7.00 level by selling foreign currencies from their massive forex reserves (when you sell a currency against the yuan, the yuan goes up). But that can’t last forever, and if their forex reserves drop below $3 trillion, markets will start to get nervous about China’s ability to keep the yuan stable. This is particularly important, as over the weekend China will release its currency reserves for December. That number better be above $3 trillion, or Monday could be a down open.

How We Position for It: Again, I’m not saying this yuan volatility will cause a pullback, but the chances of a one-time, large yuan devaluation are rising, and that could cause global macro volatility in Q1. From a positioning standpoint, the best way to hedge against a China-inspired pullback in stocks is EUM, the inverse emerging market ETF. That ETF protected portfolios in Sept/Aug ’15 and Jan ’16, and I’m confident it will do so again if China/yuan volatility causes a pullback in stocks.

Bottom line: The yuan volatility is not a problem for stocks yet, but I do want everyone to understand the context in case we do see a big, one time devaluation of the yuan in Q1 2017, as that might cause a knee-jerk, “risk off” trade of lower stocks/lower commodities/lower dollar/higher Treasuries.

Going forward, the two key numbers to watch are $7.00 yuan/dollar (a break above that level is bad) and $3 trillion Chinese Foreign Cash Reserves (a break below that number would be bad). If either occur, chances of another China-inspired pullback in stocks will rise.

Did you enjoy the “Stock Market Update” excerpt from The Sevens Report, please sign up for our updates or subscribe and get a two week money back guarantee.

Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe (the European and German flash PMIs were light). There were also a lot of earnings reports, but they were the normal gives and takes, and none of the big companies reporting really moved markets beyond their specific sector (JNJ weighed on healthcare, but that’s it).

Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe (the European and German flash PMIs were light). There were also a lot of earnings reports, but they were the normal gives and takes, and none of the big companies reporting really moved markets beyond their specific sector (JNJ weighed on healthcare, but that’s it).

Stock Market Update excerpt from the Sevens Report: Foreign markets were open yesterday, and generally traded lower on consolidation, but overall the weekend was quiet and nothing negative occurred.

Stock Market Update excerpt from the Sevens Report: Foreign markets were open yesterday, and generally traded lower on consolidation, but overall the weekend was quiet and nothing negative occurred. Stocks were basically flat throughout the morning yesterday in what was very quiet trading. Trump really dominated the narrative all day yesterday as the Russian “dossier” story weighed on sentiment slightly pre-open on Wednesday, and that was made worse by the fact that there was no economic data or corporate news to distract from the Trump story.

Stocks were basically flat throughout the morning yesterday in what was very quiet trading. Trump really dominated the narrative all day yesterday as the Russian “dossier” story weighed on sentiment slightly pre-open on Wednesday, and that was made worse by the fact that there was no economic data or corporate news to distract from the Trump story. Trump dominated sector trading as well yesterday as this comments about “bidding” for drug prices hit biotech stocks (NBI dropped nearly 3%) and healthcare more broadly (XLV fell 1%). XLV the only SPDR we track to finish negative yesterday.

Trump dominated sector trading as well yesterday as this comments about “bidding” for drug prices hit biotech stocks (NBI dropped nearly 3%) and healthcare more broadly (XLV fell 1%). XLV the only SPDR we track to finish negative yesterday. Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far.

Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far. The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.

The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.