A More Hawkish-Than-Anticipated Federal Reserve: February 15, 2017

An excerpt from the Sevens Report. Sign up for a two-week free trial of the full report at www.7sReport.com.

Yesterday I began profiling a couple of non-political risks to explore when making decisions for your clients and talking with prospects. Here’s the second:

Non-Political Risk 2: A More Hawkish-Than-Anticipated Federal Reserve

Profiling this risk seemed only natural, given Yellen’s Humphrey-Hawkins testimony yesterday, and her marginally hawkish comments served as a good reminder that the market is pretty complacent with regards to expected Fed rate hikes in 2017.

Yellen’s comments to the Fed on Tuesday, February 14th, were slightly hawkish.

Starting with Yellen, she was slightly hawkish in her comments mainly because of her upbeat assessment of the economy combined with her reiteration that waiting too long to hike rates would be “unwise,” and that the Fed will consider further increases at “upcoming meetings.” Finally, Yellen repeated that she expects a “few” rate hikes this year (she cited the median dots were three hikes in 2017).

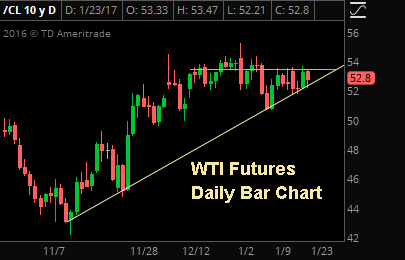

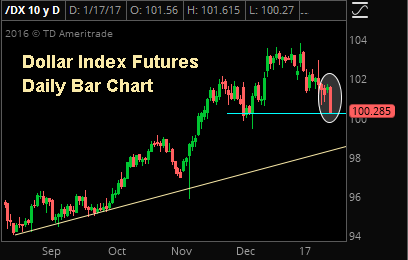

While none of those comments were new, it was a reiteration that the economy is doing relatively well and that the Fed is focused on removing accommodation, and markets reacted slightly hawkishly as the dollar rose while Treasuries declined/yields rose.

From an equity standpoint, the fact that the Fed has not been hawkish so far in 2017 has helped stocks rally, as the 10-year Treasury yield has backed away from the 2.60% level. Above that we believe higher rates will start to become a headwind on stocks. But, there is clearly a risk that rates rise higher than current expectations, and as such we want to profile that risk.

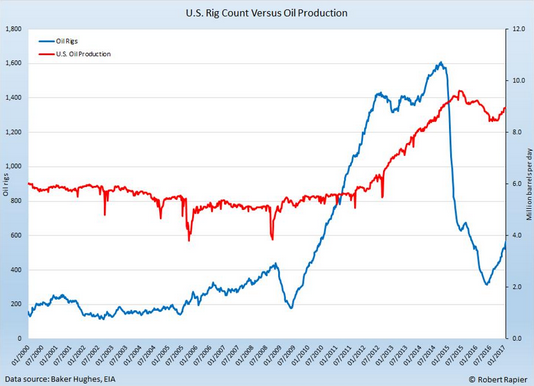

Probability of 3 rate hikes this year (one more than expected)? > 50%. This is my opinion, and it’s higher than the current consensus, but to me it makes sense. If investors think that better growth is going to support the stock market, then why do they expect that acceleration in growth not to invite more interest rate hikes from the Fed? The answer is because the Fed has been ultra dovish for years, but I believe that is changing due to multiple factors.

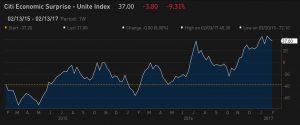

First, growth is as good as it’s been in years. Second, dis-inflation/deflation is no longer a threat (we think this is an underappreciated change in the macro-economic dynamic). Even in ’13 and ’14, when growth had periods of acceleration, inflation was still trending downward and the Fed was in full QE mode. Now, inflation is trending upwards. Third, the composition of the Fed will change as Trump can nominate three Fed members this year, and it’s a good bet they will be more on the hawkish side. So, while it’s still Yellen’s Fed, the scales should start to tilt toward the hawks later this year.

“Leading Indicators” and, “How do we position if it happens?” sections are restricted to subscribers.

Take advantage of the limited time special offer—if you subscribe to the Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Copyright 2017, Kinsale Trading LLC. All Rights Reserved. www.sevensreport.com

Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe (the European and German flash PMIs were light). There were also a lot of earnings reports, but they were the normal gives and takes, and none of the big companies reporting really moved markets beyond their specific sector (JNJ weighed on healthcare, but that’s it).

Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe (the European and German flash PMIs were light). There were also a lot of earnings reports, but they were the normal gives and takes, and none of the big companies reporting really moved markets beyond their specific sector (JNJ weighed on healthcare, but that’s it).