Dollary Futures: “Trump-Off Trade” Leads Dollar to Test Key Support

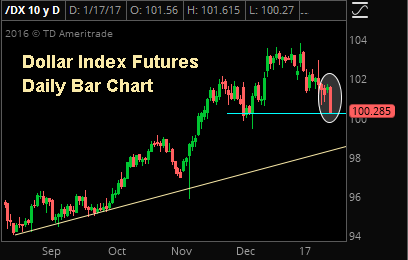

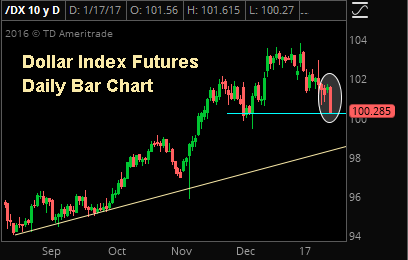

The dollar index fell into a key support level yesterday as the market remained in “Trump-Off” mode. If support just above 100 is violated, dollar index futures could quickly fall back to the uptrend line pictured above, near 98.00

Donald Trump and British PM Teresa May were the two major influences on the currency markets yesterday, as Trump’s comments to the WSJ over the weekend about the dollar being too strong, combined with May’s Brexit address being slightly less hardline than feared, caused a big drop in the greenback. Meanwhile, the pound surged nearly 3% (it’s best day since ’08). The Dollar Index closed down 0.75%.

Starting with the biggest mover on the day, the pound hit fresh multi-decade lows over the weekend on fears of PM May taking a hard line in her Brexit address (the pound briefly broke through 1.20 late Sunday). But in her comments yesterday, May said that while she will seek a clean break from the EU, any final deal will be put to a vote before Parliament.

It was the last point that ignited the pound rally, because while the news of the vote isn’t exactly positive (it will still be a “hard Brexit”) it does introduce some sort of moderating force and influence into the negotiations. And, since it was unexpected, it caused one massive short-covering rally.

Going forward, do we think today’s news marks the low in the pound?

No, not unless US economy rolls over. That’s because Brexit will be a consistent headwind on the pound for quarters and years (May said she will begin a two-year negotiation with the EU in late March). Unless you are a nimble traders, we certainly would not want to be long the pound, as we don’t think this is the start of any material rally (again, absent any rollover in the US data).

Turning to the US, Trump’s comments about the dollar being too strong over the weekend and “killing” US manufacturing hit the currency. As a result of those comments, all other major currencies were universally stronger vs. the buck. The euro and yen rose 0.80% each while the Aussie rose 1% and the loonie rose 0.60%. Nothing particularly positive occurred with those currencies, they were simply reacting to dollar weakness.

Going forward, at this point I don’t see Trump’s comments as necessarily dollar negative, and for one simple reason. If he accomplishes his goals of tax cuts, infrastructure spending and deregulation, the Fed will hike interest rates much more aggressively than is currency expected, as inflation will accelerate—and that will be demonstrably dollar positive despite what Trump says.

Near term, clearly the momentum is downward, and the dollar is testing support at 100.24. A close below that level likely opens up a run at, and through, par, with truly firm support resting in the high 90s.

Turning to Treasuries, they also traded Trump Off yesterday, in part due to the uncertainty of Trump’s comments (generally though, he didn’t say anything Treasury positive), and the 30 year rose 0.60% while the 10 year rose 0.35%. The 10 year hit a fractional two-month intraday high while yields on both bonds hovered near two-month lows.

Much like the dollar, we don’t see the recent Trump Off rally in bonds as longer-term violation of the new downtrend. Again, that’s based on the simple fact that if growth accelerates, so will inflation, and the Fed will have to hike rates faster than is expected—and that will power bond yields higher.

Near term, clearly we are seeing consolidation. If today’s CPI is light, and the Philly Fed is light later this week, and if Yellen is dovish in her comments, then we could see the 10-year yield test 2.30%. Longer term, unless we see a big reversal in economic growth, this counter-trend rally in bonds remains an opportunity to get more defensive via shorter duration bonds, inflation-linked bonds (VTIP) or inverse bond ETFs.