The first of the major central bank decisions in September comes tomorrow via the ECB, and from a general standpoint the major question heading into this meeting is:

“Will the ECB ease further, hint at easing further, or stay firmly on the sidelines?”

Given the uncertainty surrounding tomorrow’s decision, I found myself in my home office last night writing our ECB Preview (sent to paid subscribers at 7 a.m. this morning) which explained:

1) What will make the meeting “hawkish” or “dovish” and

2) Provided the anticipated market reaction of stocks, bonds, the dollar, oil and gold for the three possible outcomes: The ECB meets expectations, the ECB is Dovish, or the ECB is Hawkish.

While I was working, my wife came in and asked me what I was doing and I told her, “Writing an ECB Preview,” and she asked, “What does the ECB have to do with stocks?”

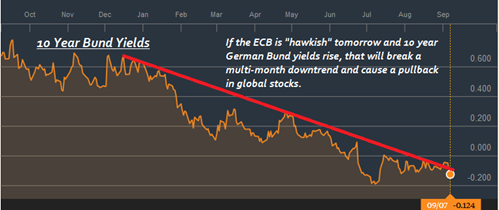

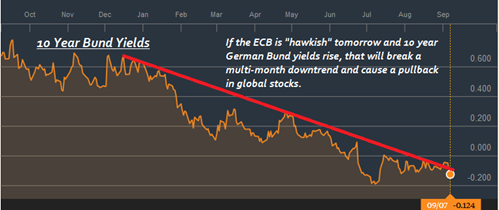

In a few quick sentences I explained that the ECB was important because if it doesn’t hint at future easing, that will make German Bund yields go up, which will make Treasury yields go up, and that will make both stocks and bonds go down!

She smiled and told me, “I Can See Why People Subscribe!”

If you’re like me, never in your wildest dreams did you think when you started in this business that you’d have to be focused on what the ECB was doing because it could turn the US stock market.

In fact, I’m not even sure the ECB existed when I started in this business!

But, a Dot-Com bubble burst, financial crisis, QE Infinity and Negative Interest Rates later, here we are, and the simple truth is that if the ECB doesn’t do one specific thing tomorrow at their meeting and press conference, it will disappoint markets—and stocks will drop (more on that later).

We have spent the last few weeks making sure our paid subscribers know the list of six key events facing markets, because those events will cause at least short-term volatility, and knowing these events are looming helps advisors who subscribe to the full, paid edition of The Sevens Report

set the right expectation for clients… so that they aren’t blindsided if any of these events cause a market pullback.

And, if the ECB, BOJ or Fed disappoints markets and causes a spike in bond yields and pullback in stocks, our subscribers will be able to demonstrate to their clients they expected the volatility

and had a plan in place should things get worse.

That’s how advisors (both active and passive managers) use The Sevens Report

to improve client relationships and impress prospects.

Tomorrow’s ECB meeting does have the potential to cause a drop in stocks, so we want to make sure everyone knows

1) What’s Expected,

2) What Will Make the ECB Dovish and

3) What Will Make the ECB Hawkish.

We’ve included an excerpt of that research for you below as a courtesy:

ECB Preview (Sevens Report Excerpt)

To keep things in plain English, the ECB is important to advisors and their clients because the decision will move both the US bond and stock markets.

If the outcome of the ECB meeting is considered “dovish” that will be positive for US stocks

because that ECB decision will pressure German Bund yields lower, and that in turn will drag US yields lower and increase the case for justifying a further multiple expansion in stocks above 2200.

Conversely, if the ECB is taken as “hawkish” that will cause German 10-year Bund yields to likely turn positive, which will push US Treasury yields higher and weigh on US and European stocks. Below we have a guide to what’s expected, what would be considered dovish, and what would be hawkish.

What’s Expected: The ECB Hints at an Extension of QE.

The current ECB QE program ends in March, and most economists expect that Draghi will strongly hint that the current QE program will be extended for a second time, likely till the end of 2017. Likely Market Reaction: Restricted for Paid-Subscribers.

It will Be Hawkish If: There is no hint at a QE extension in December. If the ECB remains in a “Wait and See” mode given the more resilient EMU economy post Brexit, that will disappoint markets. Likely Market Reaction: Restricted for Paid-Subscribers.

It Will Be Dovish If: The ECB announces the extension of QE tomorrow, or hints at both the extension of QE and upcoming changes to the QE program.

To that latter point, one of the current issues with ECB QE is that there is a relative scarcity of bonds to buy in the market, so if the ECB is planning on materially extending QE it could also change the rules regarding what bonds it can buy (likely increasing the pool of corporate and sovereign debt). Likely Market Reaction: Restricted for Paid-Subscribers.

The key takeaway here is that uncertainty surrounding global interest rates is a becoming a more substantial headwind on stocks, and that’s why stocks were down again this morning, as the Bank of England Governor Marc Carney implied the Bank of England may not need to do as much stimulus as expected, post Brexit.

Bottom line, before stocks can move higher, there has to be clarity on the direction of interest rates, and that will only come from the ECB, Fed and BOJ.

If you do not have a morning report that is going to give you the plain English, practical analysis that will help you navigate those central bank events, then please consider a quarterly subscription to

The Sevens Report.

There is no penalty to cancel, no long term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Volatility Will be an Opportunity for the Informed Advisor and Investor in the 4th Quarter

We aren’t market bears, but we said consistently that things were going to be volatile in 2016, and we were right!

The market is not going to stay as quiet as it was this summer.

How could it, considering the events that are coming over the next few weeks:

- The ECB Meeting September 8th: Will the ECB hint at more stimulus (bullish) or not (bearish)?

- The Fed Meeting September 21st: Will the Fed hike rates (very bearish), hint at hiking rates in December (bearish) or stay ultra-dovish (bullish)?

- The Bank of Japan Meeting September 21st: Will the BOJ adopt “Helicopter Money Light” (bullish), or just do another inconsequential easing like in July (bearish).

- First Presidential Debate September 26th: Will Trump get back into the race (bearish short term – and this is not a political opinion) or will Clinton maintain a comfortable lead (not bearish).

- International Energy Forum September 26th: Will OPEC and Non-OPEC members agree on a global production “freeze” (bullish oil) or not (very bearish oil).

Some advisors and investors will be blindsided by the volatility

these events might create, but the advisor who is able to confidently and directly tell their nervous clients what’s happening with the markets and why stocks are up or down, and what the outlook is beyond the near term (without having to call them back), will be able to retain more clients and close more prospects.

We view volatility as a prime opportunity to help our paying subscribers grow their books of business and outperform markets

by making sure that every trading day they know:

1) What’s driving markets

2) What it means for all asset classes, and

3) What to do with client portfolios.

We monitor just about every market on the globe, break down complex topics, tell you what you need to know, and give you ETFs and single stocks that can both outperform the market and protect client portfolios.

All for $65/month with no long term commitment.

I’m not pointing this out because I’m implying we get everything right.

But we have gotten the market right so far in 2016, and it has helped our subscribers outperform their competition and strengthen their relationships with their clients – because we all know the recent volatility has resulted in some nervous client calls.

Our subscribers were able to confidently tell their clients 1) Why the market was selling off, 2) That they had a plan to hedge if things got materially worse and 3) That they were on top of the situation.

That’s our job, each and every trading day. And, we are good at it. We watch all asset classes to generate clues and insight into the near-term direction of the markets, but our most important job is to remain vigilant to the next decline.

While we spend a lot of time trying to identify what’s really driving markets so our clients can be properly positioned, we also spend a lot of time identifying tactical, macro-based, fundamental opportunities that can help our clients outperform.

If you want research that comes with no long-term commitment, yet provides independent, value added, plain English analysis of complex macro topics, click the button below to begin your subscription today.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report

Looking at Durable Goods, longer-term readers know we ignore the headline and look straight for New Orders for Non-Defense Capital Goods ex-Aircraft (NDCGXA). That is the better measure of business spending, as the headline Durable Goods order is massively skewed by the timing of aircraft orders.

Looking at Durable Goods, longer-term readers know we ignore the headline and look straight for New Orders for Non-Defense Capital Goods ex-Aircraft (NDCGXA). That is the better measure of business spending, as the headline Durable Goods order is massively skewed by the timing of aircraft orders. The Case for Europe, an excerpt from today’s full

The Case for Europe, an excerpt from today’s full

ssion is allowing the Italian government to support any troubled Italian banks, if help is needed.

ssion is allowing the Italian government to support any troubled Italian banks, if help is needed.

This Is Not a Bearish Game Changer for the US Yet, But is A New, Material Headwind and Makes Us Cautious but Not Outright Bearish. I am not wholesale reducing US equity exposure on this news because the direction of US stocks is more tied to the economy and valuation than Europe right over the medium and longer term.

This Is Not a Bearish Game Changer for the US Yet, But is A New, Material Headwind and Makes Us Cautious but Not Outright Bearish. I am not wholesale reducing US equity exposure on this news because the direction of US stocks is more tied to the economy and valuation than Europe right over the medium and longer term.