What’s in Today’s Report:

- Why Average Inflation Matters to You

Stock futures are slightly lower this morning after a quiet night of news. There were no economic releases overnight leaving investor focus primarily on earnings.

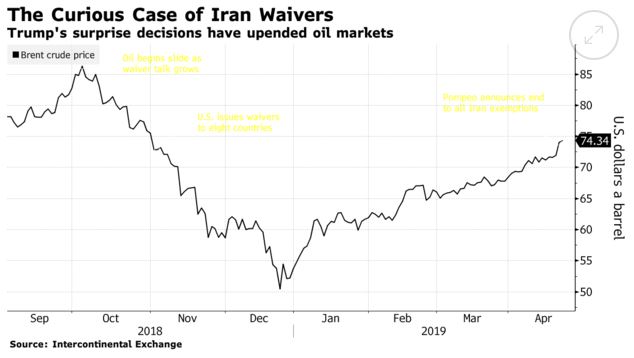

Oil is notably hitting fresh 2019 highs this morning which should continue to drive outperformance in the energy sector today.

Looking to the calendar for today, there is one economic report due out of Europe: Eurozone Consumer Confidence Flash (E: -6.9) and two reports on the U.S. housing market: FHFA House Price Index (E: 0.4%) and New Home Sales (E: 645K). There are no Fed speakers today.

Additionally, price action in stocks has been especially sensitive to the bond market since the March Fed meeting and while volatility has eased in both markets, there is a 2 Year Treasury Note Auction at 1:00 p.m. ET that could move markets.

Investors’ primary focus however will remain on earnings. Some notable releases today include: TWTR ($0.15), KO ($0.46), PG ($1.04), SNAP ($0.12), and EBAY ($0.63).