Valuation Update (Better, But Not Good)

What’s in Today’s Report:

- Equity Risk Premium Update – Better, But Not Good

- Updated Oil Outlook

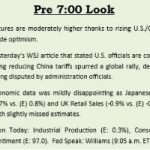

Futures are marginally weaker following a quiet night as markets as markets further digest the 2019 rally.

Economic data was sparse although Euro Zone Core HICP (their CPI) met expectations at 1.0%, which remains near multi-month lows.

Today focus will remain on earning and we get some notable consumer companies reporting (in addition to more banks). Some reports we’ll be watching include: MS ($0.90), PPG ($1.10), NFLX ($0.25),and AXP ($1.79). As has been the case so far in earnings season, the commentary on the economy will be just as important as the actual results.

We also get two notable economic reports, including Jobless Claims (E: 216K) and the Philadelphia Fed Business Outlook Survey (E: 10.0) plus one Fed speaker: Quarles (10:45 p.m. ET). Bottom line, if earnings continue to beat low expectations, stocks can grind higher for now.