Why Did Stocks Drop on Friday?

Why Did Stocks Drop on Friday? Strengthen your market knowledge with a free trial of The Sevens Report.

What’s in Today’s Report:

- Why Did Stocks Drop on Friday?

- Weekly Market Preview: Will the Fed Confirm Market Expectations?

- Weekly Economic Cheat Sheet: Important Growth Data Throughout the Week (Could Confirm or Undermine Soft/No Landing Hopes)

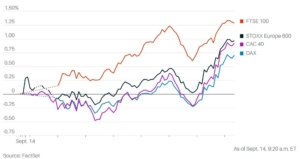

Futures are slightly higher as markets bounce following Friday’s declines and after a quiet weekend of news.

The various strikes occurring across the country (writers, UAW) contributed to Friday’s market decline. There was little positive progress over the weekend on resolving either work stoppage.

Geopolitically, President Biden’s National Security Advisor met with China’s foreign minister. The meeting is raising hopes the U.S./China relationship could improve.

Today the only notable economic report is the Housing Market Index (E: 50.0) and that shouldn’t move markets as long as it doesn’t provide a major positive or negative surprise. Barring that, we’d expect pre-Fed positioning to generally drive trading today.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.