What to Make of Yesterday’s Rally

What’s in Today’s Report:

- What to Make of Yesterday’s Rally

- Jobs Report Preview

- EIA/Oil Update (Will An OPEC Production Cut Help?)

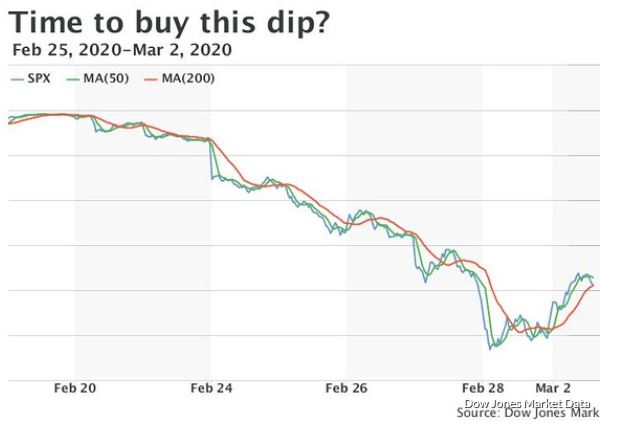

Futures are sharply lower and they are giving back more than half of yesterday’s rally as coronavirus continues to spread throughout the U.S. Clearly some of this morning’s decline is just normal give back from yesterday’s explosive rally, although economic fears are continuing to mount as the number of cancelled events, gatherings and conferences continues to rise.

There are now 160 coronavirus cases in the U.S. as California declared a state of emergency while another cruise ship is being held at sea due to fears of an outbreak. But, the news wasn’t all bad as there were just 160 new coronavirus cases in China, and evidence continues to mount that Chinese officials are getting the spread of the disease under control.

Economically, there were no notable reports overnight.

Coronavirus headlines will continue to drive trading, and broadly speaking anyreports of U.S. or global economic stimulus will be a tailwind on stocks, while any reports of an acceleration of the spread will obviously be a headwind.

Outside of coronavirus, there is just one economic report, Jobless Claims (E: 215K), but we’ll be watching this closely because it’s the best real time indicator of the labor market we have. If claims rise (say above 230k) that will fan fears of an economic fallout from coronavirus. Outside of the jobs report we also get multiple Fed speakers (Kaplan (6:30 p.m. ET), Kashkari (8:00 p.m. ET) and Williams (E: 8:45 p.m. ET)) but none of them should move markets.