What’s in Today’s Report:

- Why Surging Coronavirus Cases Aren’t Causing a Selloff

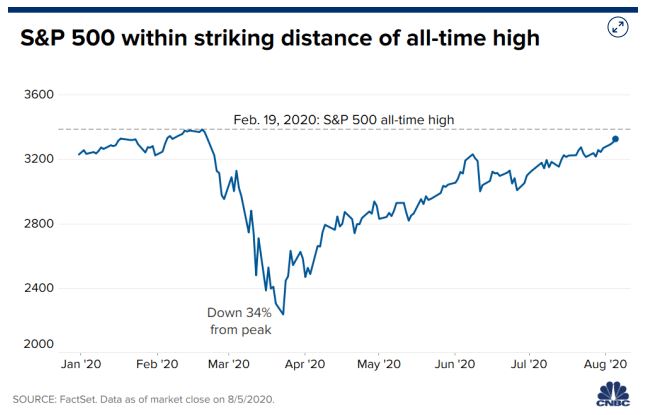

- Technical Take: S&P 500

Stock futures are trading higher with international shares as conflicting trade war headlines continue to be digested while economic data was mostly encouraging overnight.

White House trade advisor, Peter Navarro, said late Monday that the U.S.-China trade deal was “over,” but his comments were contradicted by a Trump tweet saying the deal was “intact,” which saw risk-off money flows reverse o/n.

Global Composite Flash PMIs largely topped expectations overnight, bolstering hopes that a swift economic recovery is underway.

Today, investor focus will be on economic data early as the U.S. Composite PMI Flash (E: 45.0) and New Home Sales (E: 630K) are both due out shortly after the opening bell.

There are no Fed officials scheduled to speak today but there is a 2-Year Treasury Note auction at 1:00 p.m. ET that could impact the yield curve and ultimately move the equity markets in the afternoon.

Aside from those potential catalysts, any further developments regarding the trade war or coronavirus infection rates will be closely watched as the market continues to look for direction with the S&P being tightly rangebound for the last week.