Earnings Season Update

What’s in Today’s Report:

- Earnings Season Update: Are Upside Risks Building?

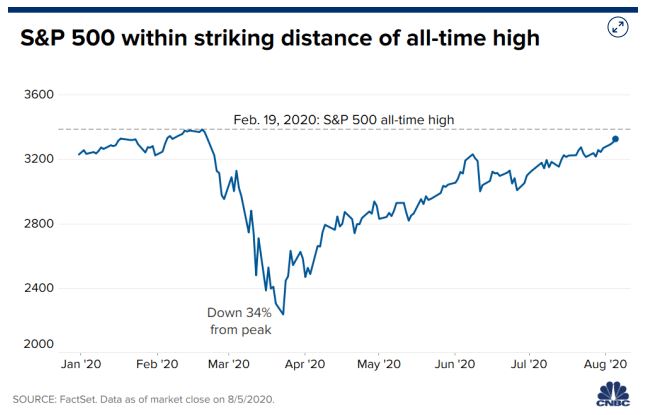

U.S. stock futures are trading lower with most overseas markets as investors digest the recent run to fresh records amid rising COVID-19 cases and mostly upbeat earnings.

German PPI was hotter than expected o/n with a headline of 0.9% (E: 0.5%) but the report is not materially moving markets.

Looking into the U.S. session today, there are no economic reports and no Fed officials are scheduled to speak. There is a 52 Week T-Bill Auction at 11:30 a.m. ET, however, that could influence bond yields and ultimately stocks if the results are far from expectations.

Earnings season will continue to pick up today with JNJ ($2.31), LMT ($6.32), PG ($1.19), and TRV ($2.44) releasing Q1 results ahead of the bell while NFLX ($2.98), CSX ($0.95), and IBKR ($0.90) will report after the close.

Bottom line, markets have been trading with a risk-off tone so far this week amid a resurgence in COVID-19 cases in several global hotspots. And if the news flow regarding the latest regional outbreaks continues to deteriorate, stocks could continue to decline, potentially sharply, as the health of the recovery will come into question.