What’s in Today’s Report:

- Jobs Report Preview (Too Hot Is the Risk)

- EIA Analysis and Oil Market Update

Futures are modestly higher as markets digest yesterday’s dovish Fed rhetoric while data overnight was solid.

German Manufacturers’ Orders and Euro Zone Retail Sales both beat estimates, again implying the economic recovery in Europe is gaining momentum (this is positive for European stocks).

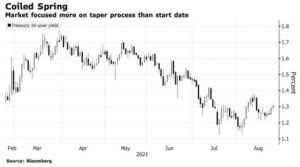

Fed officials repeated their dovish stance yesterday with Vice Chair Clarida reinforcing it’s not time to think about tapering despite rising inflation and strong growth.

Today focus will be on weekly Jobless Claims (E: 533K) and again markets will want to see them hold the gains of the past few weeks. We also get numerous Fed speakers including (in order of importance): Williams (9:00 a.m. ET), Mester (1:00 p.m. ET), Bostic (1:00 p.m. ET) and Kaplan (10:00 a.m. ET) but we don’t expect any of them to materially move markets.