Economics: This Week and Last Week. February 21, 2017

An excerpt from today’s Sevens Report. Subscribe now to get the full report in your inbox before 7am each morning.

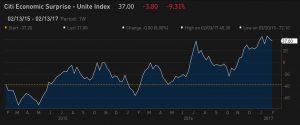

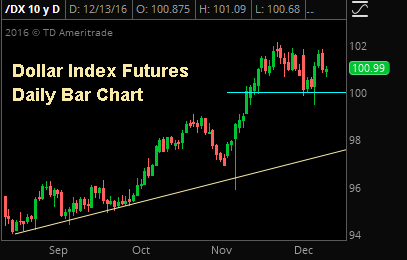

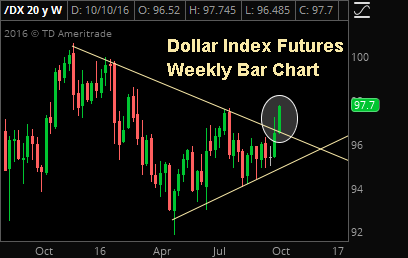

Both economic growth and inflation accelerated according to last week’s data, and while the former continues to help support stocks despite a darkening outlook from Washington, the latter also is increasing the likelihood of a more hawkish-than-expected Fed in 2017, and a resumption of the uptrend in interest rates. For now, though, the benefit of the former is outweighing the risk of the latter.

If, however, we do not see any dip in the data between now and early May, I do expect the Fed to hike rates at that May meeting, which would be a marginal hawkish surprise. To boot, if we get a strong Jobs report (out Friday, March 3), then a March rate hike two weeks later isn’t out of the question. Point being, upward pressure is building on interest rates again.

Last Week

Both economic growth and inflation accelerated according to last week’s data.

Looking at last week’s data, it was almost universally strong. Retail Sales, which was the key number last week, handily beat expectations as the headline rose 0.4% vs. (E) 0.1% while the more important “Control” retail sales (which is the best measure of discretionary consumer spending) rose 0.4% vs. (E) 0.3%. Additionally, there were positive revisions to the December data, and clearly the US consumer continues to spend (which is more directly positive for the credit card companies).

Additionally, the first look at February manufacturing data was very strong. Empire Manufacturing beat estimates, rising to 18.7 vs. (E) 7.5, a 2-1/2 year high. However, it was outdone by Philly Fed, which surged to 43.3 vs. (E) 19.3, the highest reading since 1983! Both regional manufacturing surveys are volatile, but clearly they show an uptick in activity, which everyone now expects to be reflected in the national flash PMI.

Even housing data was decent as Housing Starts beat estimates on the headline, while the more important single family starts (the better gauge of the residential real estate market) rose 1.9%. Single family permits, a leading indicator for single family starts, did dip by 2.7%, but even so the important takeaway from this data is that so far, higher interest rates don’t appear to be negatively impacting the residential housing market, and a stable housing market is a key, but underappreciated, ingredient to economic acceleration.

Finally, looking at the Fed, Yellen’s commentary was marginally hawkish, as she was upbeat on the economy, basically saying the nation had achieved full employment and was closing on 2% inflation, and reiterated that a rate hike should be considered at upcoming meetings. None of her comments were new, but the reiteration of them reminds us that the Fed is in a hiking cycle, and the risk is for more hikes… not less.

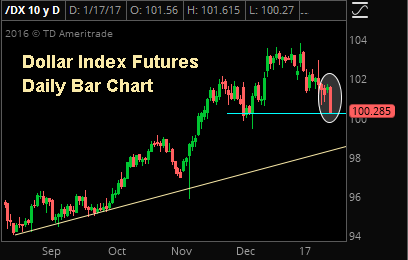

This Week

The big number this week is the February global flash manufacturing PMI, out Tuesday. With last week’s strong Empire and Philly Surveys, expectations will be pretty elevated for the flash manufacturing PMI, so there is some risk of mild disappointment. On the flip side, if this number is very strong (like Empire and Philly) you will likely see a hawkish reaction out of the markets (dollar/bond yields up) and the expectation for a rate hike before June increases. That, by itself, shouldn’t cause a pullback in stocks, but upward pressure will build on interest rates.

Outside of the flash manufacturing PMIs, the FOMC minutes from the January meeting will be released Wednesday, and investors will parse the comments for any clues as to the likelihood of a March increase. Yet given the amount of political/fiscal uncertainty, and considering the FOMC meeting was before the strong January jobs report and recent acceleration in data, I’d be surprised if the minutes are very hawkish (although given they are dated, I don’t think that not-dovish minutes reduces the chances of a May or even March hike).

Bottom line, the focus will be on the flash manufacturing PMIs, and a good number this week will be supportive for stocks.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if the Sevens Report is right for you.