Oil Update & What It Means for the Market, July 20, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Yesterday’s weekly inventory report from the EIA was universally bullish on the headline level as there were sizeable draws in crude oil stockpiles as well as in the refined products. […]

Gold and Real Interest Rate Update, What It Means for the Economy, July 19, 2017

/in Investing/by Tom EssayeJoin hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial. Gold rallied 0.67% Tuesday, as political angst spurred a fear bid while strength in the Treasury market continued to help the […]

Chinese Data Recap and What it Means for Global Markets, July 18, 2017

/in Investing/by Tom EssayeThe Sevens Report is everything you need to know about the markets in your inbox by 7am, in 7 minutes or less. Start your free two-week trial today—see what a difference the Sevens Report can make. Chinese Economic Data GDP held steady at 6.9% vs. (E) 6.8% in Q2 Fixed Asset Investment was 8.6% vs. […]

Weekly Market Cheat Sheet, July 17, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it. Last Week in Review Hard economic data continued to disappoint last week, as […]

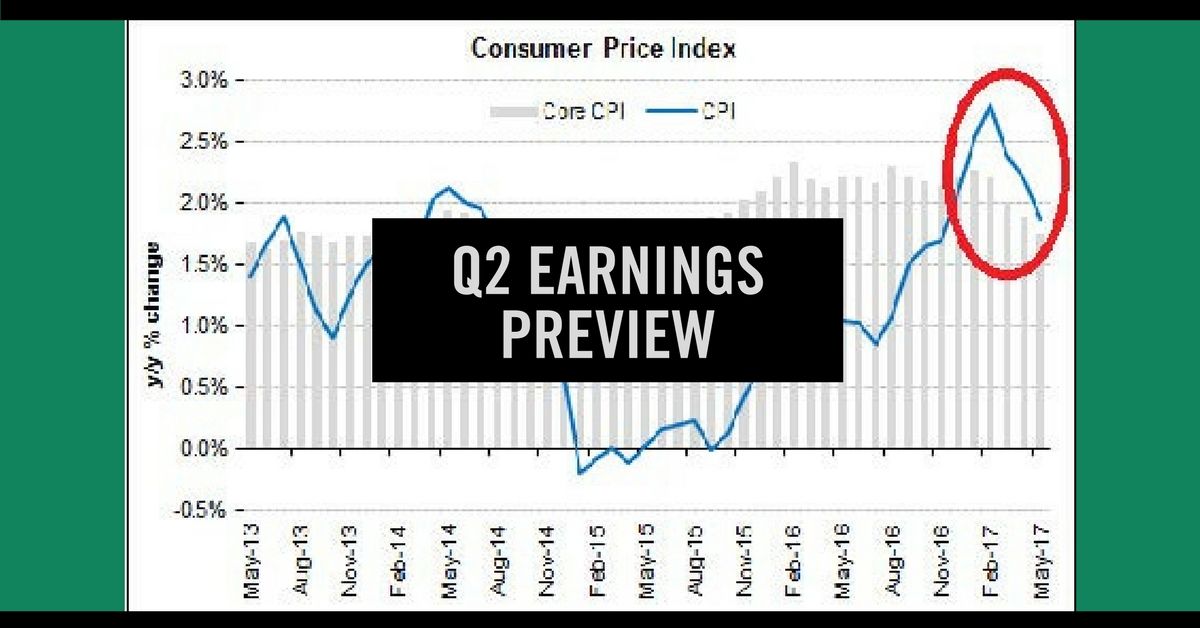

Earnings Season Preview, July 13, 2017

/in Investing/by Tom EssayeThe Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Earnings remain an unsung, but very important tailwind on the markets, in part because both 2017 and 2018 earnings keep getting revised upward. And since stock prices are just a […]

3 Times Yellen Wasn’t that Dovish in Her HFSC Testimony, July 13, 2017

/in Investing/by Tom EssayeCut through the noise and understand what’s truly driving markets. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Start your free two-week trial today. Markets interpreted Fed Chair Yellen’s comments to theHouse Financial Services Committee (HFSC) on Wednesday as […]

Trade War 2.0 Primer (Needed Context)

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: U.S. Trade Primer (Needed Context for Trade War 2.0)