Stock Market Update: January 26, 2017

/in Investing/by Tyler RicheyHere is a “Stock Market Update” from The Sevens Report: Stocks finally moved Tuesday, as the S&P 500 staged a modest rally following good economic data and well received (but not really positive) political headlines. The S&P 500 rose 0.66%. Stocks were flat to start Wednesday trade thanks to generally “ok” economic data from Europe […]

S&P Chart: Strikes New All-Time High

/in Investing/by Tyler RicheyS&P Chart: “A new high” is the oldest confirmation signal of a bull market in technical analysis and the S&P reached a new all-time high yesterday leaving the path of least resistance higher still from here.

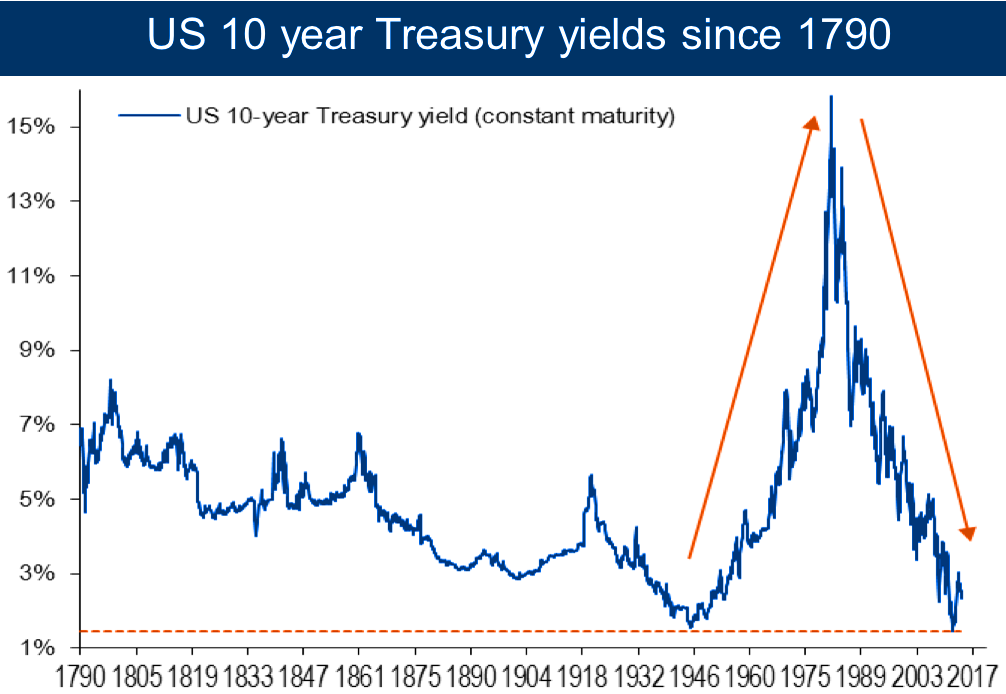

10 Year Treasury: January 23, 2017

/in Investing/by Tyler Richey10 Year Treasury: The greenback ended a volatile week little changed as the Dollar Index dropped more than 1% last Tuesday after now-President Trump called it “too strong.” Then a hawkish tone from Yellen on Wednesday, and dovish comments from ECB President Draghi Thursday, helped reverse that initial decline. The Dollar Index ended the week […]

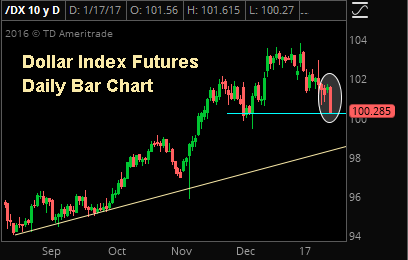

Dollary Futures: “Trump-Off Trade” Leads Dollar to Test Key Support

/in Investing/by Tyler RicheyThe dollar index fell into a key support level yesterday as the market remained in “Trump-Off” mode. If support just above 100 is violated, dollar index futures could quickly fall back to the uptrend line pictured above, near 98.00 Donald Trump and British PM Teresa May were the two major influences on the currency markets […]

Stock Market Update: January 17th, 2017

/in Investing/by Tyler RicheyStock Market Update excerpt from the Sevens Report: Foreign markets were open yesterday, and generally traded lower on consolidation, but overall the weekend was quiet and nothing negative occurred. Stocks finished last week little changed, as a Friday rally helped recoup losses from earlier in the week. Some of the shine was taken off the […]

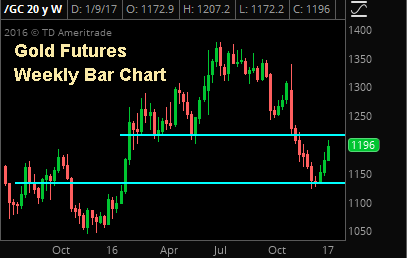

Gold Grinds Higher: Chart

/in Investing/by Tyler RicheyTurning to gold, we saw an unwind in the Trump Trade that has dominated the markets since the election yesterday morning. Reason being, the markets did not gain the clarity they were hoping to from Trump’s press conference Wednesday, so basically investors were left disappointed. Stocks pulled back, the dollar declined and bonds rallied, all […]

Is the Yen Carry Trade Become A Headwind on Markets?

/in Investing, Reports/by Tom EssayeWhat’s in Today’s Report: Is the Yen Carry Trade Become A Headwind on Markets?