Earnings Season Preview, July 13, 2017

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets.

Earnings remain an unsung, but very important tailwind on the markets, in part because both 2017 and 2018 earnings keep getting revised upward. And since stock prices are just a total of future expected earnings, those higher earnings are resulting in higher stock prices.

Given Q2 earnings season begins today, I want to take a moment and cover 1) What’s expected, and 2) How earnings can be a catalyst for a pullback, or 3) Spark a new rally.

First, to give some perspective, what’s important here is to look at the aggregate S&P 500 calendar-year earnings. Think of it as if you got the full-year earnings estimates for all 500 companies, and then added them up.

For 2017, that number (and this is an average between FactSet and Bloomberg consensus) is $131.00/share. So, on a current-year basis, the S&P 500 is trading at about 18.7X earnings (2450/131.00). That is a very historically high multiple, but not, by itself, prohibitively expensive.

For 2018, the consensus headline earnings (again an average of FactSet and Bloomberg) is $146.46. However, you have to take next year’s earnings estimates with a grain of salt, as they almost always come down throughout the year by around 5%-10%. There are multiple and varied reasons for this, but just trust me that is what happens.

So, if we reduce the $146.46 by 5%, we get $139.13. (I’m reducing it by just 5%, because corporate performance has been strong and my general caution aside, there aren’t any specific events looming out there, at this point, that should really hit corporate earnings).

At $139.13, the S&P 500 is trading at 17.6X next year’s earnings (2018). Most analysts (including me) consider 18X the “ceiling” for a next year P/E multiple. So, the markets is trading close to what most would consider a valuation “ceiling,” but it’s not there quite yet. And, given this set up, I think there are a few notable conclusions that need to be drawn from this analysis.

First, in order for this market to move higher, we must not see that $139ish 2018 S&P 500 number go down following this earning’s season. If it does, this market instantly becomes too expensive (for instance, if the expected 2018 EPS drops to $135, then the market is trading 18.15X earnings, which in my view would be too expensive).

Second, if that 2018 number moves higher following Q2 earnings season, then stocks can rally further and potentially materially so. And, we’ve seen that throughout 2017. Expected earnings for 2018 in January were in the mid $130s; however, corporate results have been stronger than expected, so that number has moved steadily higher, and that’s helped underpin the rally in stocks. If Q2 earnings season is stronger than expected and 2018 EPS get revised higher, this market can rally further and still not break above that 18X valuation ceiling.

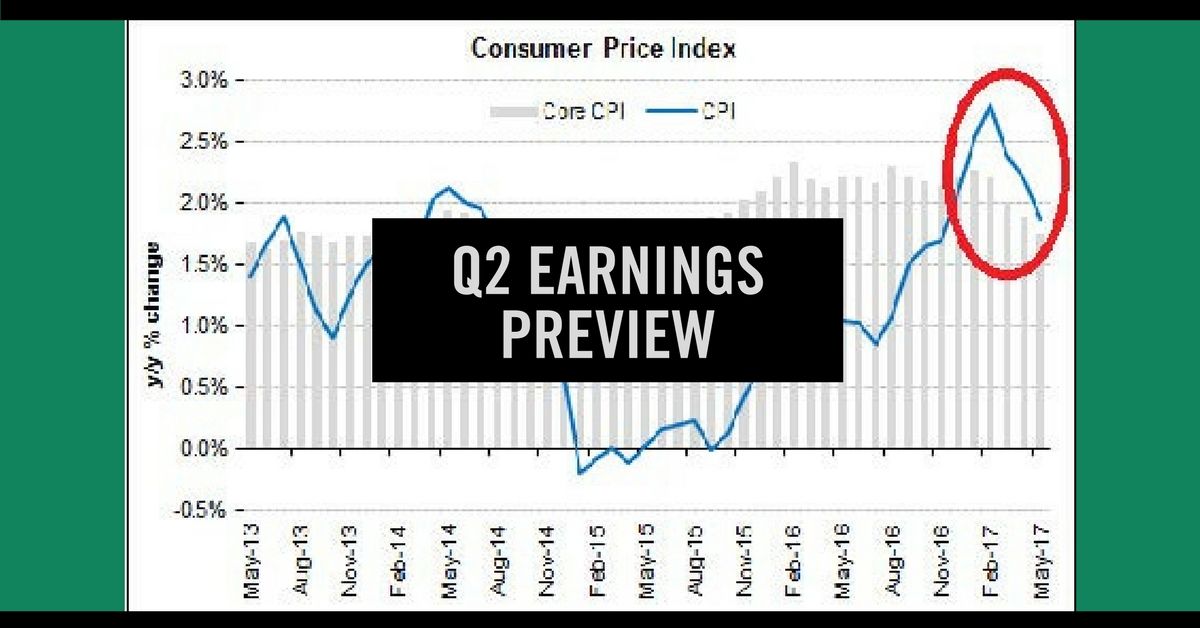

Bottom line, for all the focus on politics, the Fed and macro factors, the real push behind the 2017 rally has been earnings growth. In 2017, the S&P 500 is expected to earn $131/share. In 2018, it’s expected to earn $139/ share. That’s at least 6% earnings growth with upside risks. So, until something in the macro economy puts that earnings growth at risk (like materially higher yields, geopolitical scare, turn in US & global economic data) the fact remains that while the stock market is historically expensive, it’s not prohibitively so.

Getting this earnings season “right” from a valuation standpoint will be an important signal on whether we need to reduce exposure, or allocate more to equities. We will be watching, and as soon as we get enough numbers to get some confidence on 2018 earnings, we will let you know.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James and more… see if The Sevens Report is right for you with a free two-week trial.