What’s in Today’s Report:

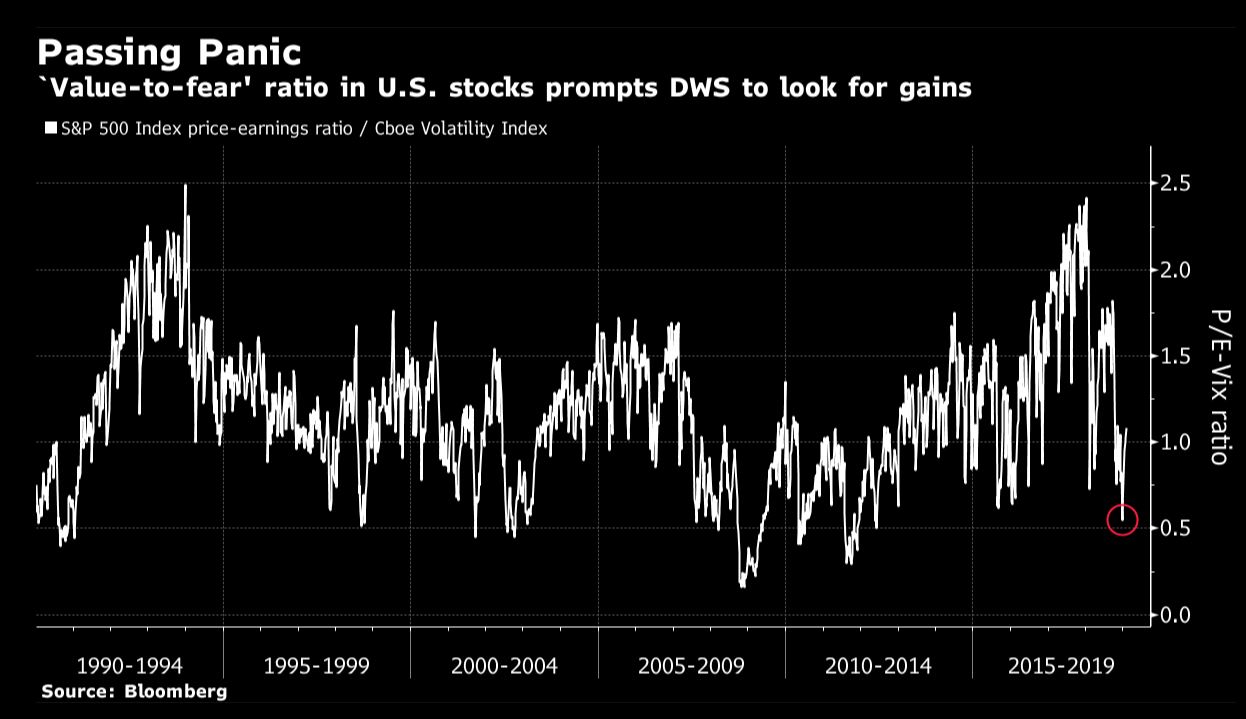

- Is this a Repeat of 2015/2016?

Futures are slightly lower as Trump’s SOTU was a non-event for markets while growth concerns continue in the wake of soft data o/n and earnings were mixed since yesterday’s close.

German Manufacturers’ Orders fell –7.0% y/y in December from –3.4% in November, the lowest reading since 2012, which is weighing modestly on EU shares in morning trade.

Looking ahead to today’s Wall Street session we are likely to see more digestion as there are limited catalysts.

There are two, second-tiered economic reports due out: International Trade (-$53.9B) and Productivity and Costs (E: 1.6%, 1.7%) while on the Fed front, Powell is scheduled to speak after the close (7:00 p.m. ET) but his remarks will be watched closely and could move markets after hours tonight.

Lastly, earnings season is winding down but there are still a few notables to watch today: GM ($1.21) and FDC ($0.37) before the open and CMG ($1.19) after the close.