The New Stimulus Bill (Good, Bad, Ugly)

What’s in Today’s Report:

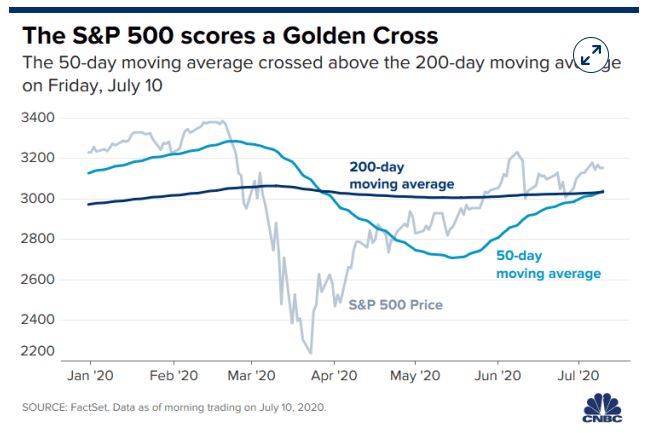

- Technical Take: Finally a Breakout

- The New Stimulus Bill: Good/Bad/Ugly

Markets are risk-on this morning with U.S. stock futures tracking European shares higher after EU leaders finalized a $2T stimulus package overnight while Q2 earnings from IBM topped expectations after the close yesterday.

The EU spending package, which importantly incorporates EU bonds, still needs to be passed by the EU Parliament and may not begin to take effect until mid-2021.

Looking into today’s session, there are no economic reports to watch and no Fed officials are scheduled to speak however the earnings calendar picks up considerably.

Companies reporting Q2 results today include: KO ($0.40), LMT ($5.71), PM ($1.09), and SYF ($0.04) before the open and SNAP (-$0.09), UAL (-$9.13), TXN ($0.87), and COF (-$1.25) after the close.