What Powell’s Renomination Means for Markets

What’s in Today’s Report:

- What Powell’s Renomination Means for Markets

- Gold Update: Cooling Inflation Outlook Favors the Bears

U.S. stock futures are trading lower with most overseas equity markets as elevated bond yields continue to weigh on big-cap tech names.

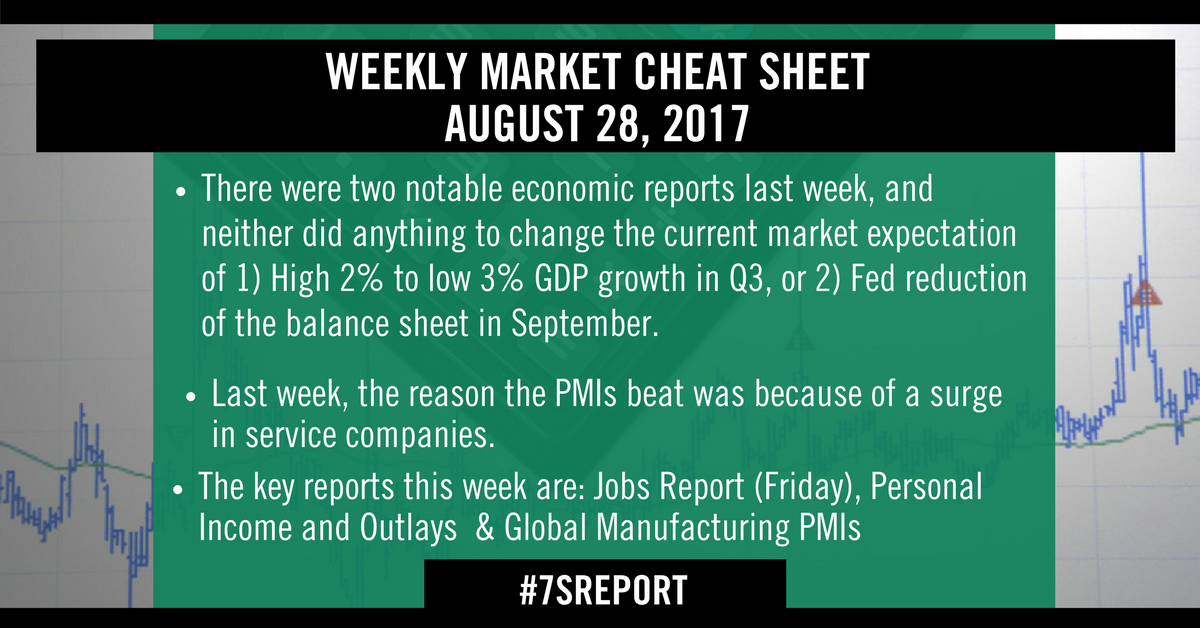

Economically, Composite PMI data in Europe was better than expected with the Eurozone figure hitting 55.8 vs. (E) 53.1 for November however the upbeat data is further supporting bond yields which are weighing on equities.

Looking into today’s session, there is one domestic economic report to watch: PMI Composite Flash (E: 57.8) and if it is as strong as the releases in Europe, that could support a further rise in yields which will keep pressure on equity markets.

There are no Fed officials scheduled to speak today but the Treasury will hold a 7-Yr Note auction at 1:00 p.m. ET that could serve as another catalyst for higher yields. And again, that is a potential negative for stocks as big-cap tech names will almost certainly extend yesterday’s late-day declines if yields continue this week’s rise.