Updating the Two Big Risks to the Rally

What’s in Today’s Report:

- Updating the Two Big Risks to the Rally

- Weekly Economic Cheat Sheet: Jobs Report Takeaways and ECB Preview

U.S. equity futures are little changed this morning while overseas markets were mixed overnight with Asian stocks outperforming on upbeat Chinese economic data but EU shares drifted lower with focus turning to this week’s ECB meeting.

Economically, Chinese Exports were encouragingly up 25.6% vs. (E) 19.5% y/y in August which supported risk-on money flows in Asian markets however a soft German ZEW Survey is weighing on EU stocks this morning.

Today’s U.S. trading session is lining up to be fairly quiet as there are no economic reports and no Fed officials are scheduled to speak.

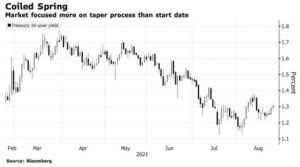

There is a 3-Year Treasury Note Auction at 1:00 p.m. ET, however, and weak demand would likely lead to a hawkish reaction across markets with yields moving higher and stocks potentially trading with a defensive tone.