Is the Ukraine Conflict a Threat to Stocks?

What’s in Today’s Report:

- Is Russia/Ukraine a Potential Major Bearish Event? (Good, Bad, and Ugly Scenarios)

- Chart: S&P 500 Tipping Points to Watch

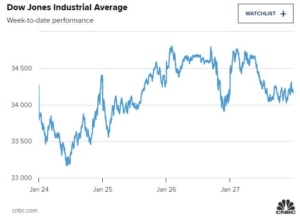

Stock futures are flat and international markets traded mixed through a quiet night of news however Treasury yields notably continued to grind higher overnight.

Economically, the January NFIB Small Business Optimism Index fell to 97.1 vs. (E) 97.5 but the release is not materially moving markets this morning.

Looking into today’s session, there is just one lesser followed economic report due out: International Trade in Goods (E: -$83.0B), which should not have a major impact on trading, while no Fed officials are scheduled to speak.

Earnings season is already beginning to wind down but a few notable releases today include: PFE ($0.85), BP ($1.18), and PTON (-$1.18).

Bottom line, investors are continuing to digest last week’s jobs print and looking ahead to the CPI report on Thursday as the main driver of the market remains central bank policy expectations. There is a 3-Yr Treasury Note auction at 1:00 p.m. ET today and with an otherwise quiet calendar the results could move markets (strong auction = dovish, stocks can rebound; weak auction = hawkish, volatility likely to rise).