Is a Yield Curve Inversion Different This Time?

What’s in Today’s Report:

- Is A Yield Curve Inversion Different This Time?

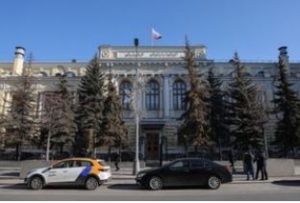

Futures are moderately higher on growing optimism for a sooner than later cease-fire in the Russia/Ukraine war.

Reuters quoted Putin as stating there had been “certain positive shifts” in the negotiations for a cease-fire, although the fighting continued and an imminent cease-fire is unlikely.

Economic data was sparse but generally fine. German CPI met expectations at 5.1% yoy while UK Industrial Production rose 0.7% vs. (E) 0.1%.

Today there is only one economic report, Consumer Sentiment (E: 61.7), and the inflation expectations index within the report will be important because if five-year inflation expectations move sharply above 3%, that will get the Fed’s attention and possibly make them more hawkish.

Outside of that report, focus will remain on Russia/Ukraine and if we get any additional hints at a cease-fire, it will extend this morning rally.