Jobs Report Preview

Jobs Report Preview: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Jobs Report Preview (How Bad Would a Too Hot Number Be for Markets?)

- Why Oil Dropped

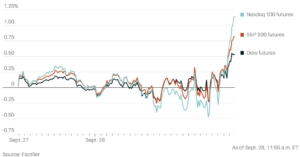

Futures are modestly lower on slightly stagflationary foreign economic data while investors digest Wednesday’s bounce and look ahead to tomorrow’s jobs report.

Economically, foreign data hinted at stagflation again as Taiwan and South Korean CPIs rose slightly more than expected while German exports missed estimates (-1.2% vs. (E) – 0.6%).

Today focus will remain on data and Fed speak. The key economic report is Jobless Claims (E: 210K) and at this point, the higher the better for stocks. We also have numerous Fed speakers today including Mester, Barkin, Daly, and Barr. However, none of them are Fed “leadership” so unless they provide surprise comments they shouldn’t move markets.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.