How Far Are Investors Willing to Stretch?

What’s in Today’s Report:

- How Far Are Investors Willing to Stretch?

- Weekly Market Preview: Wuhan virus updates, Fed testimony.

- Weekly Economic Cheat Sheet: An Important Look at Consumer Spending This Week

Futures are slightly higher following a quiet weekend of news.

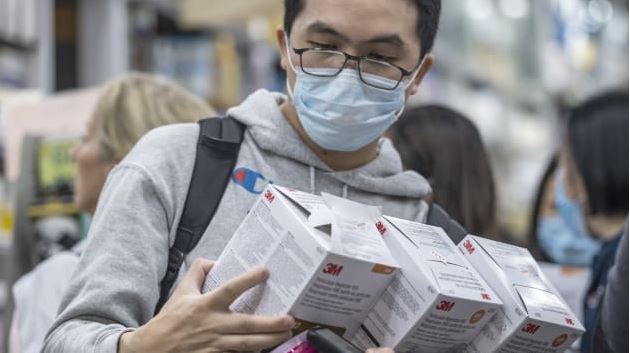

Wuhan virus related fears receded further over the weekend as the virus continued to spread, but at a slower pace than before and experts think the transmission rate of the disease has peaked. Additionally, factories in China will gradually reopen this week, potentially limiting any economic fallout.

Economic data was sparse overnight although Chinese CPI rose 5.4% vs. (E) 4.9%, which should reduce hopes of any additional, large scale stimulus from Chinese authorities.

Today there are no economic reports and no Fed speakers, so focus will remain on any Wuhan virus headlines. The key right now is the factory re-openings in China. As long as there isn’t any news that implies factory re-openings will be delayed beyond this week (and in doing so put more pressure on the economy) than Wuhan virus related fears should continue to decline.