Stock Market Update: January 17th, 2017

Stock Market Update excerpt from the Sevens Report: Foreign markets were open yesterday, and generally traded lower on consolidation, but overall the weekend was quiet and nothing negative occurred.

Stock Market Update excerpt from the Sevens Report: Foreign markets were open yesterday, and generally traded lower on consolidation, but overall the weekend was quiet and nothing negative occurred.

Stocks finished last week little changed, as a Friday rally helped recoup losses from earlier in the week. Some of the shine was taken off the “Trump Trade” following a disappointing press conference. The S&P 500 slid 0.10%.

The important price action last week didn’t come until Wednesday, when Trump’s first press conference as president-elect failed to deliver any specifics on timing for tax cuts, infrastructure spending or deregulation. Following the press conference on Wednesday, stocks immediately dropped and turned modestly negative, although buyers stepped in and the markets recovered in the afternoon to close slightly higher.

Then, stocks dropped nearly 1% in early Thursday trade, again on Trump disappointment. But support at 2250 held, and stocks were able to recover most of the day’s losses to finish down slightly (-0.28%).

On Friday, markets rallied thanks to generally “ok” economic data, and following the two resilient performances following the Wednesday/Thursday sell-off. Stocks were higher most of the day, although they gave back some of their gains Friday afternoon to finish slightly higher.

Stock Market Update: Trading Color

Tech and healthcare remain the two surprise star performers of 2017. Tech was driven higher by internet stocks (which have become the recipient of capital inflows again as investors search for value in an extended market) as (ETFs Restricted to Subscribers) our preferred internet ETF, rose more than 1%. Semiconductors also traded well despite a profit warning from TSM.

Healthcare, meanwhile, weathered a surprising negative comment by Trump and still rose last week. Healthcare remains one of our preferred contrarian allocations for 2017 based on too-negative sentiment, valuation and overdone political risk.

Looking at broad trends, the Trump trade sectors took a breather last week as banks rose slightly while energy declined on the fall in oil, and industrials underperformed. However, despite the slight decline in stocks, defensive sectors lagged as utilities and consumer staples finished modestly weaker. We expect that consolidation of the Trump trade to continue until there are hints of policy specifics.

Bigger picture, there was no clear rotation out of defensives and into cyclicals, and sector trading has been more catalyst driven in 2017. From an activity standpoint, volumes have returned to pre-holiday levels and we expect that to continue.

Stock Market Update: Bottom Line

Some shine came off the Trumpenomics rally last week due to his lack of specifics on tax cuts, deregulation and infrastructure spending at his press conference. But as we said in the Report last week, and as the resilient price action confirmed, the market will continue to give Trump/Republicans the benefit of the doubt through most of Q1. As a result, policy disappointment alone will likely not cause a near-term pullback in stocks. However, it is important to realize that the single-biggest medium/longer-term threat to the markets is political disappointment (which could cause a steep pullback in Q2/Q3).

Focusing on the near term, there are two specific reasons that the market is giving the new administration/government leeway. First, economic data was getting better pre-election, and if the data continues to improve, that means that one of the two reasons behind the Q4 rally will remain in place. Second, the market knows Washington is slow, even with one party in power. So, it’ll take something besides lack of policy clarity to cause a near-term pullback in stocks, (some risks to watch there are slowing economic data, more than three Fed rate hikes in 2017, or Chinese trade tensions).

On the flip side, if stocks are to break materially higher, we will have to get specifics on corporate tax cuts in the coming weeks. The other two pro-growth initiatives championed by Republicans (deregulation and infrastructure spending) aren’t as critical as corporate tax cuts, and that remains the key to helping the S&P 500 break materially above 2300.

From a tactical standpoint, we would continue to hold broad allocations to stocks. If you’re putting new money to work, we would focus on the value sector of the market (ETFs Restricted to Subscribers) over cyclicals or defensives.

Tactically, Europe (ETFs Restricted to Subscribers) and healthcare (ETFs Restricted to Subscribers) are two attractive contrarian opportunities, in our opinion, while banks (ETFs Restricted to Subscribers) remain attractive longer term but seem to be consolidating. We therefore wouldn’t initiate a position here (we’re holding our position and waiting for a further pullback to add to it). Bottom line, lack of policy specifics won’t reverse the rally, but some specifics have to emerge soon if this rally can continue.

This Week

Earnings come into focus this week, as it’s the first week of major company reports from virtually every sector. Unless the results are terrible or fantastic, they shouldn’t move markets too much, as potential fiscal stimulus remains the key focus right now.

From a macro standpoint, there is consistent economic data throughout the week, but CPI on Wednesday is the key number. Then we have Yellen making two speeches (Wednesday and Thursday), and comments on policy could pop up given the topic of both speeches.

Finally, as if I needed to remind anyone, Inauguration Day is Friday, and though it likely won’t have any direct market impact, it is a positive in so much as we will move forward (hopefully) towards some policy clarity.

Our paid subscribers know we will give them the succinct analysis they need to communicate effectively with their clients and strengthen their relationships.

Did you enjoy the “stock market update” excerpt?

Why not make an investment in yourself and your business? We are confident it will produce returns many times greater than the $65 per month subscription cost.

As a courtesy, I am extending a limited time, special offer to new subscribers of our full, daily report that we call our “2 week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Stocks were basically flat throughout the morning yesterday in what was very quiet trading. Trump really dominated the narrative all day yesterday as the Russian “dossier” story weighed on sentiment slightly pre-open on Wednesday, and that was made worse by the fact that there was no economic data or corporate news to distract from the Trump story.

Stocks were basically flat throughout the morning yesterday in what was very quiet trading. Trump really dominated the narrative all day yesterday as the Russian “dossier” story weighed on sentiment slightly pre-open on Wednesday, and that was made worse by the fact that there was no economic data or corporate news to distract from the Trump story. Trump dominated sector trading as well yesterday as this comments about “bidding” for drug prices hit biotech stocks (NBI dropped nearly 3%) and healthcare more broadly (XLV fell 1%). XLV the only SPDR we track to finish negative yesterday.

Trump dominated sector trading as well yesterday as this comments about “bidding” for drug prices hit biotech stocks (NBI dropped nearly 3%) and healthcare more broadly (XLV fell 1%). XLV the only SPDR we track to finish negative yesterday.

Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far.

Healthcare and super cap internet stocks were again the positive story yesterday, and five trading days into 2017 they are the clear surprise winners so far.

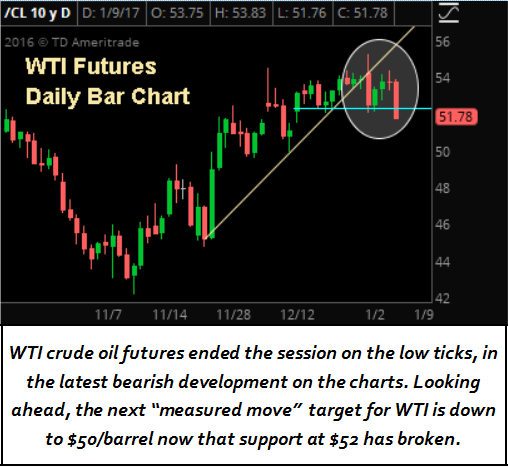

The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.

The weekly oil inventory report was taken initially as bearish, and that caused a pullback in stocks as the drops in oil at 10:30 and 11:00 led the break lower in the major averages, as oil remains a shorter-term influence over the stock market. But both oil and stocks bottomed for the day right around 11:30, and both began rallies that lasted until oil’s close at 2:30. With no other notable news (and an important jobs report this morning) stocks chopped sideways before closing slightly lower.

Markets lost a bit of momentum midday as politics interjected into yesterday’s trade (a theme we should all get used to in 2017). Trump’s tweet about GM (he mentioned border taxes) helped stoke some worries about trade issues for 2017 (although the announcement that Ford was keeping a plant in the US was met positively). The Stock Market drifted lower on general digestion, and hit the lows for the day up just 7 points in the S&P 500. However, stocks bounced off intraday support at 2245 and rallied during the final 30 minutes to finish with solid gains.

Markets lost a bit of momentum midday as politics interjected into yesterday’s trade (a theme we should all get used to in 2017). Trump’s tweet about GM (he mentioned border taxes) helped stoke some worries about trade issues for 2017 (although the announcement that Ford was keeping a plant in the US was met positively). The Stock Market drifted lower on general digestion, and hit the lows for the day up just 7 points in the S&P 500. However, stocks bounced off intraday support at 2245 and rallied during the final 30 minutes to finish with solid gains.