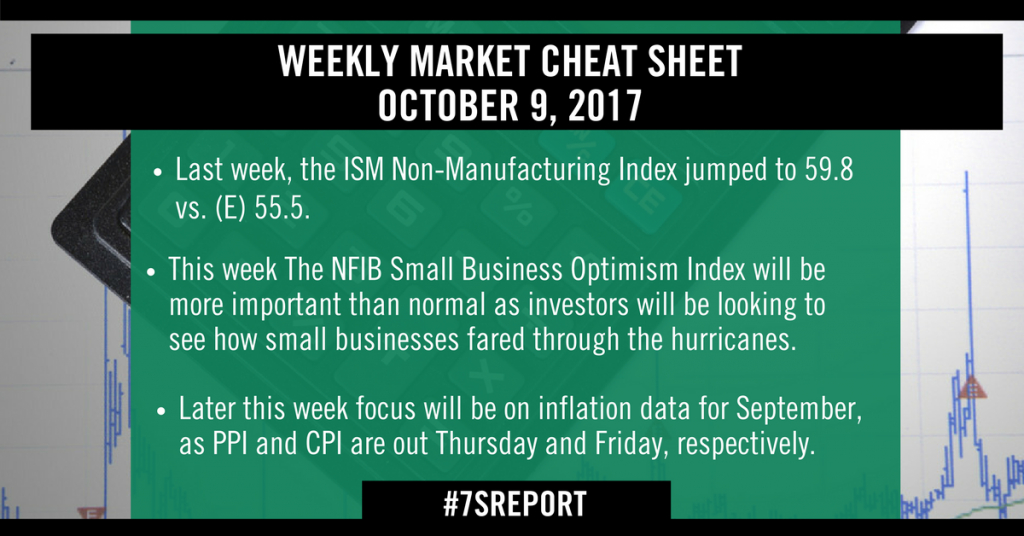

The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, leading indicators, seize opportunities, avoid risks and get more assets. Get a free two-week trial with no obligation, just tell us where to send it.

Macroeconomic Drama Rundown (It’s Not That Bad, Yet)

Over the past week, the macro environment has suddenly become populated with multiple headline grabbing (and seemingly dire) macroeconomic dramas, and I imagine you might be getting calls about these dramas from clients.

So I want to: 1) Cover each drama, 2) Explain why it’s not materially important to the market yet (despite the headlines) and 3) Identify what has to happen for these events to cause a pullback. I’ve covered each event in order of their respective potential importance to the markets.

Drama 1: North Korea

What’s Happened? More communication, some official, some not. Secretary of State Tillerson is apparently in direct talks with the North Koreans on some sort of deescalation. However, that comes as President Trump tweets vague threats implying the only option is military. It’s unclear if this is some geopolitical game of “Good Cop/Bad Cop,” or just an administration that’s not on the same page (the answer likely depends on which papers you prefer reading), but the point is that on the surface, rhetoric remains unnerving (at least the public rhetoric).

What’s Next? North Korea is expected to test another long-range missile sometime between Oct. 10 and Oct. 22.

Bearish Game Changer If: This has remained consistent: Talk is just talk and it won’t cause anything other than a brief pullback. But, this geopolitical drama becomes a reason to de-risk if North Korea shoots the missile at anything US, including planes, ships and Guam. At that point, the potential for a US military strike on North Korea goes up considerably, and we would advise getting more defensive in nature (i.e. buying Treasuries or going to cash).

Drama 2: Iran Nuclear Deal

What’s Happened? President Trump is expected to decertify the Iran deal on Oct. 12 (Thursday). This is important, because once President Trump announces that he believes Iran is not in compliance with the deal, a 60-day clock starts ticking. Over those 60 days, Congress must decide whether to reimpose sanctions on Iran (it’s not President Trump’s decision).

What’s Next? Thursday’s official announcement on the Iran deal (it’s not a sure thing that Trump will decertify the deal, so there’s some drama here).

Bearish Headwind If: Congress decides to reimpose sanctions on Iran, causing a total collapse of the

international agreement. This outcome would not, by itself, constitute a reason to materially de-risk (i.e. sell stocks). I say that because stocks rallied for years while there was no agreement in place. However, taken in the context of the North Korea nuclear program, Iran/Russia ties, etc., this entire situation would get potentially much more complicated and dangerous, as markets will take notice and it would be a headwind (but not enough to cause a material pullback).

Drama 3: Catalan Independence

What’s Happened? On Oct. 1, Catalonia (a region of Spain where Barcelona is located) held a referendum on independence from Spain. That referendum passed with 90% of the vote choosing independence. However, less than 50% of the population voted, so that’s more impressive than it seems (meaning the majority of Catalans didn’t vote for independence). The proper analogy to understand this situation is to think of this like a US state having a vote to try and se- cede from the nation. States can’t just vote to leave the US, and neither can Catalonia vote to leave Spain. The vote was illegal and meaningless, outside of the fact that it has stirred up a Spanish political hornet’s nest.

What’s Next? The President of Catalonia will speak on the matter tomorrow night, and will either declare independence (legally it will mean nothing) or will vow to negotiate with the Spanish government on enacting some changes to make the Catalan people happy.

Bearish Headwind If: This one has been a bit exacerbated by the press. First of all, Catalonia has wanted to secede from Spain pretty much since it was conquered by Spain in the 1700s. Catalan culture is different from Spain (they speak Catalan, which is different than Spanish) and the people always have considered themselves different from the rest of Spain. So, it’s not shocking they held the vote.

Second, this is as much a money issue as a cultural one (surprise!). Catalonia is wealthy compared to the rest of Spain. And, the Catalan people perceive (somewhat correctly) that they subsidize the rest of Spain, and they are tired of it (years of recession will do that).

At this point, there are three ways it can go:

The “Good” scenario is that the Catalan government and Spanish government negotiate this out (this is the likely outcome). The “Bad” scenario is the Catalan government declares independence and the Spanish government fires the entire Catalan government and assumes control of municipal services and holds a new election. The “Ugly” scenario is the Spanish government declares martial law and occupies Catalonia (this is very unlikely).

But, even if the “Ugly” scenario come to pass, this is still mostly a local problem. For it to become a bearish game-changer for European ETFs and US stocks, we’d need to see Catalonia achieve independence, and spur an independence movement across Europe. ZeroHedge is warning of this, but in reality, it’s very, very unlikely.

This drama is not something keeping me up at night.

Drama 4: Turkish Diplomatic Drama

What’s Happened? The US has stopped issuing all non-immigrant visas in Turkey, and the Turkish government retaliated and is doing the same. This conflict is just the latest drama surrounding Muslim cleric Fethullah Gulen.

Over the weekend, the Turkish government arrested a Turkish US embassy worker the government believes is linked to Gulen. The Turkish government blames Gulen for the failed 2016 coup, and this is a problem, because Gulen currently lives in Pennsylvania and the US won’t hand him over.

What’s Next? Diplomats are working through it, and it’s unlikely to metastasize into a bigger problem.

Bearish Headwind If: The US and Turkey suspend all diplomatic ties (which is very, very unlikely).

Bottom Line

Absent the North Korea flare up that began in August, 2017 has been largely devoid of any international dramas, which is a departure from most of the current decade. Yet clearly there has been an uptick in geopolitical uncertainty over the past few weeks.

However, while the financial media is quick to cover the worst-case scenarios from these events, the facts tell us that none of them, at this point, represent a reason to alter positioning or to de-risk. More importantly, tax cuts remain the key political and geopolitical event to focus on during Q4. That can obvi-ously change, but so far none of these dramas are nearly as important to stocks as whether we get tax cuts. And, if that changes, we will tell you first thing.

Cut through the noise and understand what’s truly driving markets, as this new political and economic reality evolves. The Sevens Report is the daily market cheat sheet our subscribers use to keep up on markets, seize opportunities, avoid risks and get more assets. Sign up for your free two-week trial today and see the difference 7 minutes can make.