Why the Bar for the Fed to Be Hawkish Is High

Why the Bar for the Fed to Be Hawkish Is High: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Why the Bar for the Fed to Be Hawkish Is High

- What the CPI Report Means for Markets

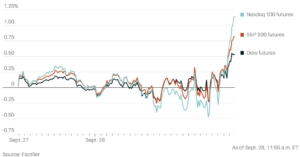

Futures are slightly higher despite soft economic data, as markets await the Fed decision later this afternoon.

Economically, data from the UK and the EU was bad and is slightly increasing growth concerns. UK monthly GDP and UK & EU Industrial Production all missed estimates.

Chinese growth concerns also rose as China declared industrial development as the #1 economic priority, potentially signaling less economic stimulus in 2024.

Today focus will be on the FOMC decision (2:00 p.m. ET, No change to rates expected) and the keys are the 2024 dot (does it show 50 bps of cuts?) and whether Powell slams the door on the idea of rate cuts (or leaves it slightly open). In addition to the Fed, we also get another important inflation reading via PPI (E: 0.1% 1.0%). A further decline will be peripherally positive for markets.

Annual Discounts on Sevens Report, Alpha, Quarterly Letter, and Technicals.

We’ve been contacted by advisor subscribers who wanted to use the remainder of their 2023 pre-tax research budgets to extend their current subscriptions, upgrade to an annual (and get a month free) or add a new product (Alpha, Quarterly Letter, Technicals).

If you have unused pre-tax research dollars, we offer month-free discounts on all our products. If you would like to extend current subscriptions or save money by upgrading to an annual subscription, please email info@sevensreport.com.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.