“Is the Stock Market Too Expensive?” February 23, 2017

“Is the Stock Market Too Expensive?”

That’s a question I’m getting asked a lot lately by subscribers and colleagues.

With stocks at record highs, there is a lot of worry that the market is unsustainably expensive. But, that’s simply not the case.

Yesterday, in the full edition of The Sevens Report, we broke it down.

- Provided a three-part analysis of what makes the market 1) Expensive, 2) Fairly Valued (with some room for upside) and 3) Cheap

- Named each catalyst that would decide that valuation level

- Listed specific sector and style ETFs that we believe can outperform in this valuation environment.

Excerpt from that research below:

Valuation Update: How Overvalued Are Stocks?

It’s no secret that stocks are richly valued, but while those high valuations make me generally uncomfortable (I’m a value investor at heart) I do feel the need to push back a bit on the idea that valuations, alone, are a reason to lighten up on equity exposure.

Yes, in some scenarios the stock market is simply “too expensive.” Still, there are other, more plausible scenarios where I can show the market as reasonably valued or even cheap. Here are a few of those scenarios.

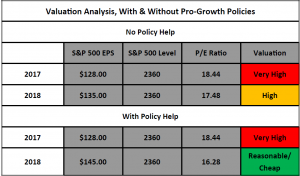

The Market is Too Expensive If: You’re Looking at Current Year Earnings. Looking at current year earnings, the S&P 500 is historically very expensive. With consensus $128 2017 S&P 500 EPS, the S&P 500 is trading at a whopping 18.44X current year earnings. Anything above 18X has proven (longer term) historically unsustainable.

The Market Is Not Too Expensive (Yet) If: You Look At Next Year’s (2018) Earnings (And This is Without Any Tax Cuts). Consensus 2018 (so next year) EPS are around $135, which does not include any benefit from a corporate tax cut. At $135, the S&P 500 is trading at 17.4X next year’s earnings. Yes, that is expensive (the 20-year average is 17.2X per FactSet) but it’s not unsustainable, not in an environment with historically low interest rates and an apparent macro-economic acceleration.

In fact, if the macro set up doesn’t change (and we don’t get any definitively bad news from Washington), I could see investors pushing that multiple to 18X, or 2,430 in the S&P 500 (about 3% higher from here).

Above that, I think the market would get somewhat prohibitively expensive, but that would depend on what’s happening with the economy, inflation and rates.

The Market Is Cheap If: Real, Material Corporate Tax Cuts Get Implemented. If we do get material corporate tax cuts in 2017, most analysts think that would add at least $10/share to S&P 500 EPS, bringing the 2018 number from $135 to $145.

At $145 EPS, the S&P 500 would be trading at just 16.3X next year’s earnings, which in this environment could easily be considered reasonable if not outright cheap.

“Is the stock market too expensive?”

Six Value ETFs That Can (and Have) Outperformed

From a practical standpoint, the fact that the stock market is on the expensive side historically does reinforce my preference for value-oriented ETFs. Since late 2016, we’ve focused our tactical strategies on sectors we considered a “value” and they have handily outperformed the S&P 500:

- In September of 2016, we strongly advocated getting long banks due to 1) Compelling valuation and 2) The start of the uptrend in bond yields. Since that call on September 26, our preferred bank ETF has risen 41%!

- In late 2016, while many analysts were chasing cyclical sectors in the wake of the election, we instead advocated buying value in super-cap internet stocks. Our preferred internet ETF has risen 9.8% in 2017, handily outperforming the S&P 500.

- At the start of 2017, we cited the maligned healthcare sector as our preferred contrarian play for 2017, based on the idea that overly negative political fears had created a value opportunity. Our two preferred healthcare ETFs have risen 7.3% and 7.5% so far in 2017, and we think that trend of outperformance will continue.

- More broadly, we have identified two “Value” style ETFs that we believe will outperform the markets in this current macro-environment, and these two broad ETFs remain our preferred vehicle to be generically “long” the market.

The Sevens Report doesn’t just help you cut through the noise and focus on what’s truly driving markets – we also provide tactical idea generation and technical analysis to help our subscribers outperform. You can sign up for your free trial today: www.7sReport.com.

“This is a huge value add. If I can avoid even a modest portion of significant market pullbacks, and be well-invested during bull markets based on your Dow Theory calls, my clients will be extremely happy with me. I already look like a genius to them!” – Financial Advisor with a National Brokerage Firm, New York, NY.