What’s in Today’s Report:

- What Mexican Tariffs Mean for Markets (New Worst Case Scenario)

- Two Leading Indicators of Market Contagion We’re Watching

- Fed Policy Update

- EIA/Oil Outlook

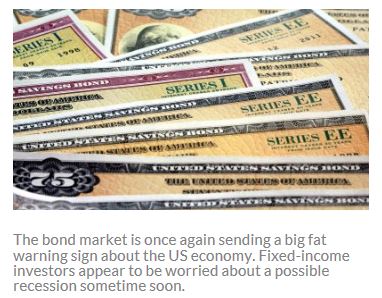

Futures are down 1% as President Trump announced tariffs against Mexican imports in response to the border crisis, while Chinese economic data missed expectations.

Trump announced a 5% tariff on Mexican imports in June and rising each month there after until they hit 25%.

The March Chinese manufacturing PMI missed estimates at 49.4 vs. (E) 49.9 adding to global growth worries.

Today the key number is the Core PCE Price Index (E: 1.6% yoy) and if that number prints stronger than estimates, expectations for a Fed rate cut will drop further and given everything else happening today, markets could get ugly. Conversely, a soft inflation number will increase calls for a rate cut, and stocks could steady on that news.

The other key event today is a speech by New York Fed President Williams, and markets will want to see if he has a dovish tone following the tariff announcement and recent soft data (if he does, that’s a positive).