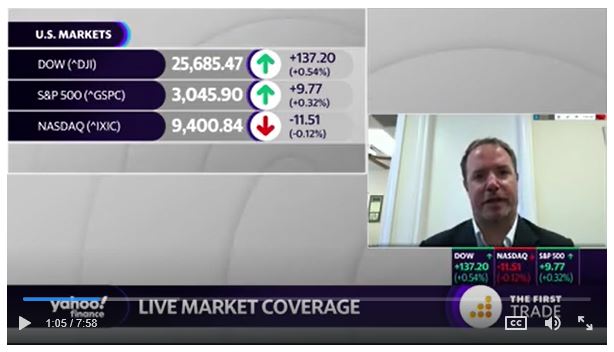

Market Multiple Levels: S&P 500

What’s in Today’s Report:

- Market Multiple Levels: S&P 500 Chart

- What Do Protests Mean for Markets

S&P futures are once again up by double digits today as more stimulus chatter by global central banks and good economic data offset intensifying civil unrest in the U.S.

Economically, global Composite PMI data for May was mostly upbeat with Chinese and EU figures coming in ahead of expectations while the EU Unemployment Rate in April was not as bad as feared at 7.3% vs. (E) 8.2%.

Looking into the U.S. session, focus will be on economic data early with three notable reports due to be released: ADP Employment Report (E: -8.663M), Factory Orders (E: -14.0%), and ISM Non-Manufacturing Index (E: 44.0).

There are no Fed officials scheduled to speak today so investor focus will likely turn back to the protests across much of the country as well as the simmering geopolitical tensions between the U.S. and China after this morning’s economic data.

Bottom line, if economic data in the U.S. largely confirms the upbeat data from overseas, the rally could extend higher towards 3,100 in the S&P 500 however the market is becoming near-term overextended and due for a breather.