A New Real Time Economic Indicator

What’s in Today’s Report:

- A New, Real Time Economic Indicator

- EIA and Oil Market Update

- Why The U.S. Dollar Is Near Multi-Month Lows Again

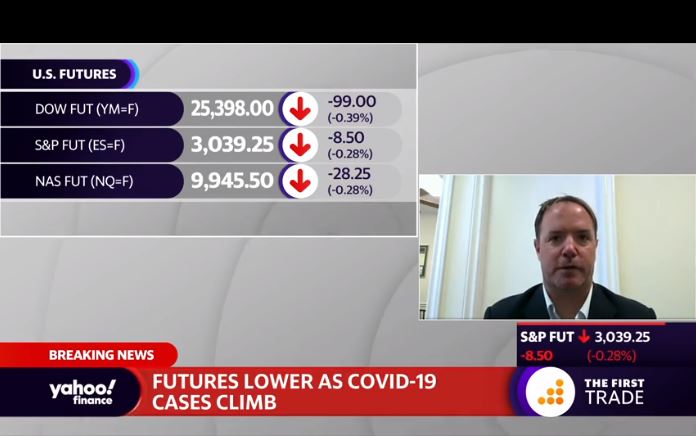

Futures are slightly lower following a generally quiet night of news as markets digest Wednesday’s afternoon rally.

Economic data was mixed as Japanese Machine Orders beat estimates (1.7% vs. (E) -9.0%), but German Exports missed expectations (rising just 9.0% vs. (E) 14%).

The U.S. set another record for new coronavirus cases (61k) although markets continue to take the surge in stride, for now (more on that in tomorrow’s Report)

Today focus will be on weekly Jobless Claims (E: 1.375M) and if they bounce back towards 2 million, that will be a headwind on stocks as it will imply the economic recovery is stalling.

We also have one Fed speaker, Bostic (12:00 p.m. ET), and presumptive Democratic nominee Biden will give his first major economic policy speech, but neither event should move markets.