Jobs Day

What’s in Today’s Report:

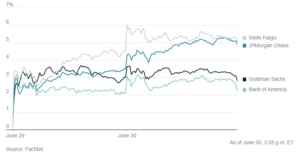

- How the Two-Year Yield Caused Yesterday’s Drop in Stocks

- EIA Analysis and Oil Market Update

Futures are slightly lower following a mostly quiet night of news as investors wait for this morning’s jobs report.

Economic data underwhelmed as Japanese Household Spending (-1.1% vs. (E) 0.5%) and German Industrial Production (-0.2% vs. (E) -0.1%) both missed expectations.

Taiwan exports also fell more than expected, down 23.4%, and that’s adding to general anxiety about future global growth.

Today the only major event is the June jobs report and expectations are as follows: 213K job adds, 3.7% UE Rate, 0.3% wage increase m/m and 4.2% y/y. As we saw from yesterday’s ADP report, a “Too Hot” number will spike yields and further pressure stocks, as the rise in yields is now getting high enough to be a headwind on the market. Conversely, a “Too Cold” number will increase stagflation worries.

A job adds number in the 100k range coupled with an increase in the unemployment rate and a drop in wages remains the best outcome for stocks, and if we get that number don’t be surprised if the S&P 500 recoups all of yesterday’s losses.