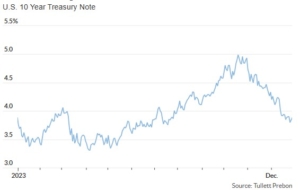

Why Did Stocks and Bonds Drop to Start 2024?

Why Did Stocks and Bonds Drop to Start 2024? Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Why Did Stocks and Bonds Drop to Start 2024?

- Weekly Market Preview: Can Data Meet Market Expectations For Growth and Rate Cuts?

- Weekly Economic Cheat Sheet: Inflation In Focus (CPI on Thursday)

Futures are slightly lower following some disappointing EU economic data and on hawkish Fed commentary.

Economically, German Manufacturers’ Orders and Euro Zone retail sales both missed estimates, reminding investors of recession risks in Europe.

This weekend, Dallas Fed President Logan warned that financial conditions have eased materially recently and that may prevent the Fed from cutting rates anytime soon.

Today there are two notable market events including the NY Fed Inflation Expectations (E: 3.4%) and comments by Atlanta Fed President Bostic (12:00 p.m. ET). If either event pushes back on the idea of imminent rate cuts (via inflation expectations being higher than estimates or Bostic sounding hawkish) expect more modest pressure on stocks and bonds.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.