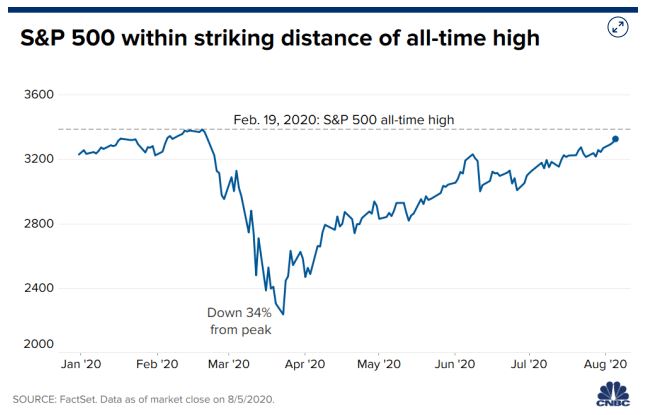

How Does the S&P 500 Get to 4500?

What’s in Today’s Report:

- How Does the S&P 500 Get to 4500?

- Weekly Market Preview: Important inflation data, bank earnings, and Treasury auctions.

- Weekly Economic Cheat Sheet: Inflation Wednesday, April Data Starts Thursday.

Futures are slightly lower following a “not as dovish as expected” 60 Minutes interview of Fed Chair Powell.

Fed Chair Powell was more optimistic on near-term economic growth during a 60 Minutes interview on Sunday, and while he was by no means “hawkish,” his tone was taken as less dovish than expected and that’s weighing slightly on futures.

Economically, the only notable number was EU Retail Sales which beat expectations, rising 3.0% vs. (E) 1.2%.

Today there are no economic reports and only one Fed speaker, Rosengren (1:00 p.m. ET), so focus will remain on the 10 year yield. Today there’s a 10 year Treasury auction and tomorrow there’s a 30 year Treasury auction. If yields can remain stable amidst this stock rally, then the S&P 500 can continue to move higher. But, if we see a resumption of the rise in yields, expect a headwind on stocks.