What’s in Today’s Report:

- Why the Sintra Comments Were Slightly Hawkish (And What They Mean for Markets)

- Clarifying the “Growth On” Trade vs. “Growth” Style

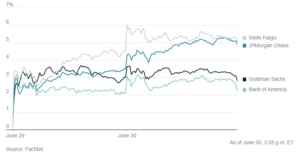

Futures are modestly higher after all 23 U.S. banks passed the Fed’s annual stress tests.

The 23 largest banks in the U.S. passed the Fed’s annual stress tests, and while none were expected to fail, the fact that there were no negative surprises is a general positive for the banking sector and financials.

Economically, Euro Zone Economic Sentiment, was basically in-line with expectations and isn’t moving markets.

Today focus will be on economic data, and the key reports today are: German CPI (E: 6.3% y/y), Jobless Claims (E: 270k) and Final Q1 GDP (E: 1.4%). Markets have priced in “Immaculate Disinflation” so inflation needs to continue to fall everywhere (including Germany), while markets also need to see jobless claims gradually rise (a big spike in claims would be a negative) to keep to bullish momentum going.

Sevens Report Q2 ’23 Quarterly Letter Coming Monday, July 3rd.

The Q2 2023 Quarterly Letter will be delivered to subscribers on Monday, July 3rd.

Stocks were surprisingly strong in the first half of 2023, but with investor sentiment now very bullish and the financial media proclaiming a new “Bull Market” has started, it’s important for advisors to keep client expectations grounded. A well-written quarterly letter that details the opportunities and risks facing investors can keep investor expectations grounded.

We will deliver the Q2 ‘23 Quarterly Letter on the first business day of the new quarter because we want you to be able to send your quarterly letter before your competition (and with little-to-no work from you).

You can view our Q1 ’23 Quarterly Letter here.

To learn more about the product (including price) please click this link, and if you’re interested in subscribing please email info@sevensreport.com.