What’s in Today’s Report:

- Why Stocks Faded Yesterday (And Why They Are Down This Morning)

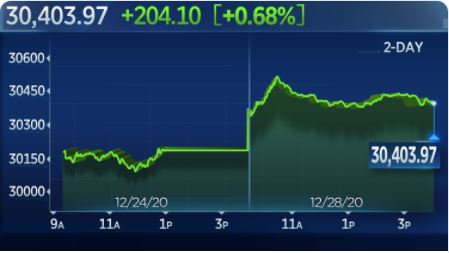

Futures are moderately lower on disappointing economic data and as optimism on stimulus fades slightly.

On stimulus, the political reality of Washington is starting to impact markets, and it’s becoming more unclear when Democrats’ ambitious stimulus goals will become law.

Economically, global flash PMIs were bad. Japanese, EU and British PMIs all fell further below 50 and there was significant deterioration across the board from the December readings, implying that the coronavirus lockdowns are having a negative impact on global growth (and slowing global growth isn’t priced into stocks).

Today the key number will be the Flash Composite PMI (E: 55.5). Markets will be looking for stability and for the U.S. to avoid the slowing of activity that we saw in the global data earlier this morning, because again a material slowing in growth is not priced into stocks at these levels. We also get Existing Home Sales (E: 6.540M) later this morning.

Finally, earnings season remains in full swing, and some reports we’ll be watching today include: ALLY ($ 1.05), SLB ($ 0.18) KSU ($1.91).