FOMC Preview (Watch the Dots)

What’s in Today’s Report:

- FOMC Preview (Watch the Dots)

- Why Yesterday’s CPI Boosted the “Growth On” Trade

- Gold Update: Are the 2023 Highs Already In?

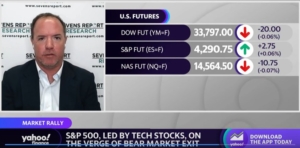

Futures are modestly higher following a quiet night of news as markets look ahead to the FOMC decision and expected pause in rate hikes.

Economic data was mixed overnight as UK Industrial Production missed estimates (-0.3% vs. (E) -0.1% in manufacturing) while Euro Zone IP slightly beat (1.0% vs. (E) 0.9%), but neither number is moving markets.

Today focus will be on the FOMC Decision and the consensus expectation is that the Fed will pause. But, it’s not clear how many additional 2023 rate hikes the “dots” will show, and that will determine if the Fed decision is hawkish or dovish (more on that inside).

Away from the Fed we also get the May PPI (E: -0.1% m/m, 1.6% y/y) and Core PPI (E: 0.2% m/m, 2.9% y/y) and if this metric comes in under expectations that’ll boost the “Immaculate Disinflation” expectation and should help cyclical sectors extend the rally.