Bounce or Bottom? A Key Level to Watch

What’s in Today’s Report:

- Bounce or Bottom? A Key Level to Watch

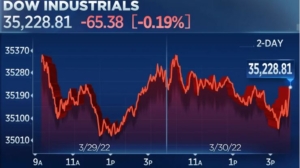

Futures are slightly higher following a night of mixed earnings and continued reopening in China.

Shanghai continued to reopen and Beijing is still avoiding the most draconian lockdowns and that’s helping broader market sentiment.

Economic data was sparse as the only notable report was Euro Zone M3 (6.2% vs. (E) 6.3%) but that’s not moving markets.

Today the key report is the Core PCE Price Index (E: 0.3%, 4.9%) and if it underwhelms vs. expectations and furthers the idea that inflation has peaked, look for a continuation of this week’s rally. We also get Consumer Sentiment (E: 59.1) and the key there will be the five-year inflation expectations. If they drop below 3.0%, that’ll be an additional positive for stocks today.