CPI Preview: Good, Bad, and Ugly

CPI Preview: Good, Bad, and Ugly: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- CPI Preview: Good, Bad, & Ugly

- Chart: S&P 500 in Typical Holding Pattern – Two Levels to Watch

- NFIB Small Business Optimism Index – Inflation Concerns and Declining Earnings

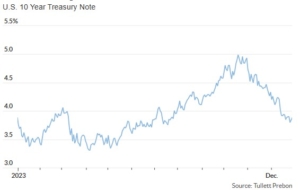

There is a cautious bid in equity futures today as the 10-Yr yield hovers just under 4%. This is following an importantly steady inflation print in Europe and dovish leaning ECB chatter.

Economically, Norwegian CPI rose 4.8% in December, unchanged from November. Which is just below estimates of 4.9% which is a favorable development following last week’s concerning uptick in German CPI.

ECB Vice President Luis de Guindos was mildly dovish in a speech overnight, citing the possibility that the economy fell into a technical recession in late 2023 which could support the case for a more accommodating policy stance and that is helping keep yields in check this morning.

Looking into today’s session, there are no notable economic reports but one Fed speaker on the schedule who could move markets: Williams (3:15 p.m. ET).

In the early afternoon, three is a 10-Yr Treasury Note auction (1:00 p.m. ET) and investors will want to see more evidence of strong demand as was seen in yesterday’s 3-Yr auction as weak demand could send the benchmark yield up through 4% creating a renewed headwind for equity markets.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.