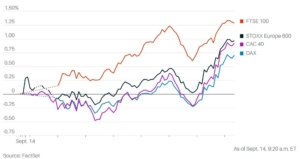

Economic Data Fueled the Rally

Why Economic Data Fueled the Rally: Strengthen your market knowledge with a free trial of The Sevens Report.

What’s in Today’s Report:

- Why Yesterday’s Economic Data Fueled the Rally

- An Important Chart (On Page One)

Futures are slightly higher on more Chinese economic optimism as data was better than expected while Chinese officials announced more stimulus.

Chinese Retail Sales (4.6% vs. (E) 3.9%) and Industrial Production (4.5% vs. (E) 3.9%) beat expectations while authorities injected 120 billion yuan into a lending facility.

Today’s focus will be on economic data and if data is “Goldilocks” like we saw on Thursday, expect a continuation of yesterday’s rally. Conversely, if the data shows inflation hot or growth slowing, the markets could give back most of yesterday’s rally.

Also, the important reports to watch today include: Empire State Manufacturing Index (E: -10.0), Import and Export Prices (E: 0.3%, 0.4%), Industrial Production (E: 0.1%), and Consumer Sentiment (E: 69.2).

Finally, today is quadruple witching options expiration so don’t be surprised by big volumes and increased volatility during the final hour of trading.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.