What’s in Today’s Report:

- Is a Ceasefire in Ukraine a Bullish Catalyst?

- Oil Chart: Trend Remains Higher

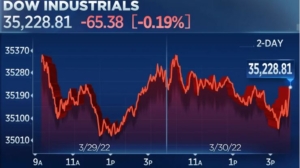

Stock futures are lower with EU shares amid negative economic forecasts, a deteriorating state of Russia-Ukraine negotiations, and growing concerns about the yield curve.

Geopolitically, the Kremlin stated that the latest talks have not been “promising” and much work still needs to be done which is weighing on risk assets and bolstering oil prices this morning.

Economically, Germany cut its GDP growth forecast to just 1.8% in 2022 from 4.6% previously and an EU economic sentiment survey missed estimates.

Looking into today’s session, focus will be on jobs and growth data early with the ADP Employment Report (E: 438K) and Final Q4 GDP report (E: 7.1%) due out before the bell.

Additionally, there are two Fed speakers: Barkin (9:15 a.m. ET) and George (1:00 p.m. ET) but based on this morning’s price action, geopolitics remain the most notable influence on markets, and sentiment towards the war in Ukraine will likely be the biggest driver of markets again today.