Time to Buy Puts?

What’s in Today’s Report:

- Time to Buy Puts?

- Weekly Market Preview (All About Earnings)

- Weekly Market Cheat Sheet (GDP Friday is the Key Report)

Futures are modestly lower thanks to higher oil and new concerns about the longevity of Chinese economic stimulus.

The South China Morning Post released an article saying Chinese officials will again focus on structural economic reforms, which means limited future economic stimulus.

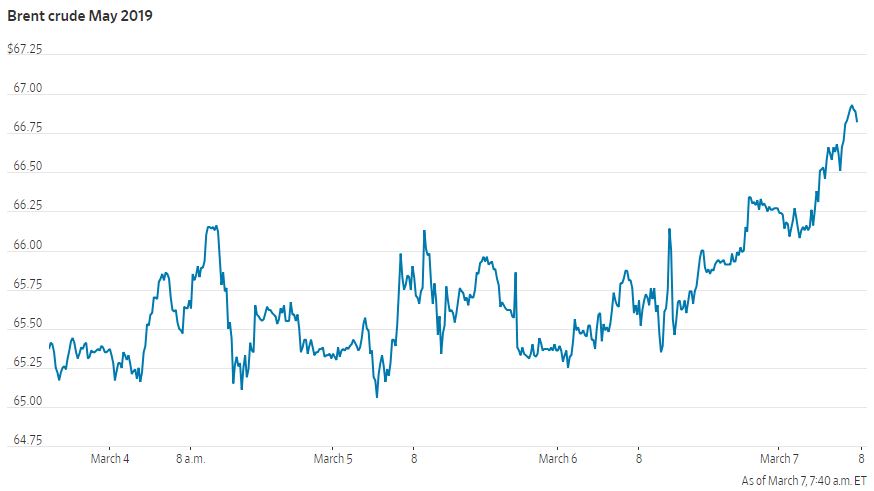

Oil is 2% higher following reports the Trump administration will not renew any Iranian import wavers.

Today there is only one economic report, Existing Home Sales (E: 5.30M), and that won’t move markets.

So, the key to trading today will be earnings, and here are the reports we’re watching: HAL ($0.23), KMB ($1.54), WHR ($3.04).