What Could Go Wrong in 2022

What’s in Today’s Report:

- What Could Go Wrong in 2022

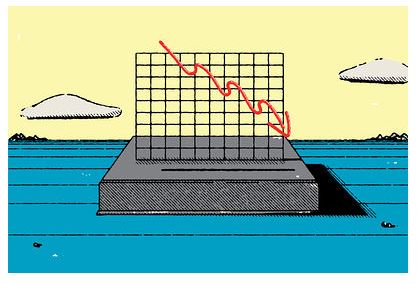

- Chart: Rate Hike Prospects Weigh on Nasdaq

Futures are modestly higher despite negative COVID headlines and a mixed outlook for China’s economy.

New COVID cases topped 1 million and set a record for a second day Tuesday as the highly contagious, but less severe Omicron variant continues to rip through hot spots around the globe. But for now, few nations have implemented new lockdowns allowing investors to look past the latest surge in cases.

According to Bloomberg Economics, China’s economy grew this month but property sector risks remain a key concern and that weighed on Asian shares overnight.

Today, there are two economic reports due out: International Trade in Goods (E: -$86.0B), and Pending Home Sales (E: 0.6%) but once again, neither should move markets as they should not shift the outlook for monetary policy.

There are no Fed speakers today but there is a 7-Year Treasury Note auction at 1:00 p.m. ET. If the auction is weak and yields rise materially, that could add pressure to higher valuation sectors of the market like tech/Nasdaq and drag the broader equity markets lower in thin holiday trading today. Otherwise, the Santa Claus rally remains in effect and the path of least resistance does still remain higher given the recent records in the S&P 500.

Sevens Report Q4 ’21 Quarterly Letter Coming January 3rd

The Q4 2021 Quarterly Letter will be delivered to advisor subscribers on Monday, January 3rd.

With several key macro issues coming to a head in the next few weeks, we believe the first quarter could be the most volatile of 2022.

We deliver the letter on the first business day of the new quarter because we want you to be able to send your quarterly letter before your competition (and with little to no work from you).

You can view our Q3’21 Quarterly Letter here.

To learn more about the product (including price) please click this link, and if you’re interested in subscribing please email info@sevensreport.com.