Jobs Day (Updated Jobs Report Preview)

Jobs Day: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- Jobs Day (Updated Jobs Report Preview)

Futures are solidly higher ahead of today’s jobs report thanks to strong earnings overnight.

META (up 17% pre-market) and AMZN (up 7% pre-market) posted strong earnings while AAPL (down 2% pre-market) underwhelmed, but overall earnings results were good overnight and that’s pushing futures higher.

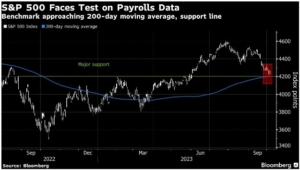

Today focus will be on the jobs report and expectations are as follows: 187K job adds, 3.8% Unemployment Rate, 0.3%/4.1% wage growth. Powell pushing back on a March rate cut helped increase the threshold for a “Too Hot” report, so there’s a wider lane for a “Just Right” reading. But, if job growth remains very strong (so solidly above 200k) and the other details are “Too Hot,” don’t be surprised if yields rise and stocks decline as some investors start to doubt a May rate cut.

Other notable events today include Consumer Sentiment (E: 78.8, 1-Yr inflation expectations: 2.9%) and the last “important” day of earnings, although neither of those should move markets.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.