SL: Is the Bond Bull Market Over? (Central Bank Preview)

In the next 24 hours we’re going to get the answer to two very important questions:

- Is the Bond Bull Market Over?

- Have We Seen the Highs in Stocks for 2016?

And, it’s the Bank of Japan that likely will decide the answers to those questions, which will decide whether we see a potentially sharp decline in both stocks and bonds.

I’m not one for patting myself on the back, but I don’t know of many other research firms that were pounding the table back in August (when the market was quiet) saying:

- The July rally in stocks was in trouble because global bond yields were moving higher (they did, and the S&P 500 is down 2% from the August highs), and

- That the Bank of Japan and ECB were more important to US stocks than the Fed (the ECB caused a pullback two weeks ago and the Bank of Japan may do so tomorrow).

So, now I’m reiterating that tomorrow is a potentially very important day for clients’ stock and bond holdings, because even if we don’t see a lot of volatility immediately following the meetings, the Bank of Japan decision may mean the continuation of this rally in global bond yields, and the decline in stocks.

And, that could have significant consequences on clients returns as we enter the fourth quarter.

We are committed to making sure our paid subscribers know, before their competition, whether the Bank of Japan will cause global bond yields to move higher or lower, because that will be the key to getting clients properly positioned to outperform in Q4.

We’ve already delivered our Plain-English BOJ Preview to paid subscribers and they already know:

- What The Market Expects from the BOJ

- What will Make the Meeting “Dovish” and the likely market response

- What will Make the Meeting “Hawkish” and the likely market response

So, tomorrow, while other advisors and investors are searching WSJ.com, MarketWatch or CNBC to try and determine whether the meetings were bullish or bearish for stocks and bonds, our subscribers will already know.

But, more importantly, our subscribers know that at 7 a.m. Thursday morning we will deliver clear, Plain-English analysis of what the meetings mean for all asset classes (Stocks, Bonds, Commodities, Currencies) in the short and long term, and what tactical ETFs or general allocations we think will outperform in Q4 and beyond (and if that means raising cash, we’ll say it!).

Our paid subscribers won’t have to wait for a delayed, compliance-approved recap from their brokerage firm that just explains what the BOJ or Fed did, and ignores how to either protect gains or profit from the decisions.

We are going to tell our subscribers (at 7 a.m., and in plain English): 1) What Happened, 2) What it Means for Client Holdings (Stocks, Bonds, OI, Gold, the Dollar) and 3) How We Think We Can Make Money from It.

And, because this is such an important time for markets, we will be hosting a special webinar this Thursday at 1 P.M. EDT titled: “Breakout or Breakdown? 4th Quarter Market Preview.”

We will discuss the outlook for both stocks and bonds (and how we think investors should be positioned) heading into the 4th quarter.

There are a lot of moving pieces to tomorrow’s BOJ meeting and there aren’t a lot of clear, easy-to-read previews out there, so I’ve included an excerpt of our BOJ Preview as a courtesy:

BOJ Preview: What’s Expected

The fear going into tomorrow’s meeting will be that the BOJ will tacitly admit that it is indeed out of bullets, and is no longer able to provide meaningful stimulus to the Japanese economy. And while Japan is a unique case, this matters to all developed stock markets for two reasons.

-

First, and most directly, if the BOJ raises a symbolic white flag tomorrow, Japanese Government Bond yields will keep rising, which will make US Treasury yields rise, and that will keep a headwind on stocks.

-

Second, global stock markets have been supported (or propped up, depending on your definition) by the idea of ever more accommodative central banks. If the most aggressive central bank just declared itself impotent to spur further growth or inflation, what does that say about the ability of other central banks to support stocks prices/the economy if we see a slowdown? I often say at its heart, the market is little more than a confidence indicator, and a BOJ that disappoints markets again will strike a big blow to market confidence.

Bottom line, for global stock and bond markets that have been driven higher by the expectation of forever-low rates and ever-increasing central bank stimulus, having the most active player tacitly admit defeat is not good.

Now that we have the context, let’s look at what’s expected (there are a lot of moving pieces here, so bear with me):

-

QE: The first thing I will look at when I get up Wednesday will be to see if the BOJ increased the amount of QE. What’s Expected: No change to QE. If there is no change to QE, this BOJ decision will be at best neutral for stocks.

-

Interest Rates:

What’s Expected: Deposit Rate Cut from -.1% to -.3%.

Wildcard to Watch: If the BOJ increases the inflation target from 2% to 3% (or close to 3%) that will be a surprise dovish move, and be taken as an unexpected positive (positive for stocks, negative for global bond yields).

Have a Plan In Place If Yields Keep Rising (and Stocks Keep Falling)

If you’re like me, and most advisors and investors, the biggest risk for tomorrow’s meetings is that global bond yields keep rising and stocks keep falling, creating an extension of the past 10 days where both stocks and bond holdings are falling together.

Given that risk, we spent last week providing subscribers with our “Higher Rate Playbook” they can refer to if we see that negative outcome, because in that scenario protecting profits and finding sectors that can outperform will be critically important! Paid subscribers already have this tactical playbook they can refer to, because we all know thinking clearly gets much more difficult when markets are falling!

Play #1: Get Short the Long End of the Yield Curve, and/or Reduce the Overall Duration in any Bond Ladders

If we see a sustained decline in bonds/rally in yields, the belly and long end of the yield curve will get hit much harder than the short end of the yield curve.

There are two reasons for this:

First, the long end (say beyond 10 years) is over inflated because of foreign money, and as such has a lot further to fall before we get to compelling values.

Second, the short end of the curve (really 2 years or less) trades off Fed expectations, and the Fed simply isn’t going to raise rates quickly regardless of what happens in the markets (and especially if we see a selloff in stocks). So, the Fed will anchor the short end of the yield curve while the longer end rises, meaning the declines in short-term bonds will be less than in longer-term bonds.

ETFs to Get “Short” the Long Bond (there are many ETFs to do this but this is a list of the most liquid and targeted): Restricted for Subscribers

What to Buy in the Bond Markets: Restricted for Subscribers.

We don’t think everything in the bond market is toxic and we continue to have a top pick in the fixed income market for incremental capital that is less than five-year duration and the best alternative in a bond market that may be broadly declining.

Play #2: Focus on Good (but not Great) Credit Quality in Corporates

First, I think there may be opportunities for additional yield in the tier right below the top end of investment grade.

Point being, I would take the extra yield in that space between AAAs and junk, because barring a broad economic slowdown, corporate balance sheets are as strong as they’ve been in years.

Second, if I had a large allocation to junk bonds, I would rotate into higher-quality corporates because junk will get hit, and hit hard, in a declining bond market (think of junk bonds as the “subprime” of the bond market). Yes, junk pays a good yield, but in a rising rate environment it’s not worth the incremental risk.

How to Get Short Junk Bonds: Restricted for Subscribers.

How to Put on a Long Investment Grade/Short Junk Spread:

Restricted for Subscribers.

Play 3: Shift Exposure in US Stocks Out of “Yield Proxy Sectors.” (Know the difference between high-yielding sectors and truly defensive sectors).

If bonds and stocks keep falling, sector selection is going to become very important, and knowing the difference between truly “defensive” sectors vs. sectors that pay big dividends will matter for performance.

We provided the specific defensive sectors we like to paid subscribers in a report last week.

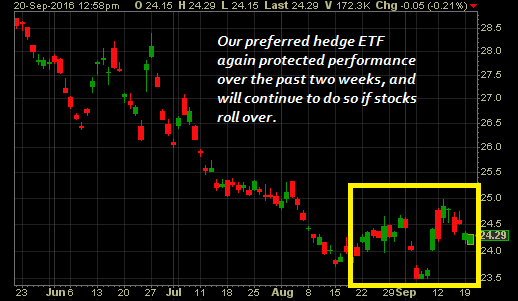

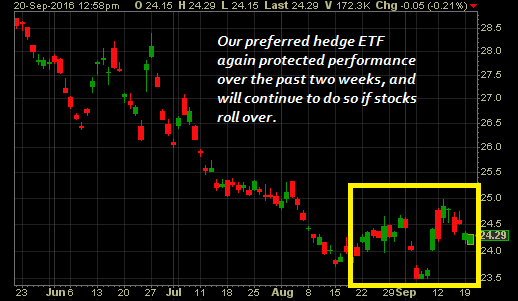

Play 4: Get a General Hedge Against “Risk Off.”

For over a year now we’ve used a specific inverse ETF as a broad hedge against a “risk-off” move in stocks, as this ETF has direct, specific exposure to some of the weakest sectors of the market, and as such can cushion any broad declines in the markets (like we saw in August/December 2015 and in January/February 2016).

We provided this specific ETF to subscribers once again in a report last week.

To be clear, I’m not advocating taking any of these steps right now, as it’s simply not clear that the bond market has indeed turned. So, we have to be wary of (another) head fake in this multi-year bull market.

But, if the bond market does turn and 10-year Treasury yield moves towards 2%, it is important that advisors have a plan before the declines start, because things could get ugly quickly.

If you don’t have a morning report that is going to give you the plain-spoken, practical analysis that will help you navigate the BOJ and Fed decisions tomorrow, and help you get positioned properly to outperform into year end, then please consider a quarterly subscription to The Sevens Report.

There is no penalty to cancel, no long-term commitment, and it costs less per month than one client lunch!

With thousands of advisor subscribers from virtually every firm on Wall Street and a 90% initial retention rate, we are very confident we offer the best value in the private research market.

I am continuing to extend a special offer to new subscribers of our full, daily report that we call our “2-week grace period.”

If you subscribe to The Sevens Report today, and after the first two weeks you are not completely satisfied, we will refund your first quarterly payment, in full, no questions asked.

Click this link to begin your quarterly subscription today.

Value Add Research That Can Help You Finish 2016 Strong!

Our subscribers have told us how our focus on medium-term, tactical opportunities and risks has helped them outperform for clients and grow their businesses.

We continue to get strong feedback that our report is: Providing value, helping our clients outperform markets, and helping them build their books:

“Thanks for your continued insight; it has saved my clients over $2M USD this year… Keep up the great work!” – Top Producing FA from a National Brokerage Firm.

“Let me know if there is anything else that you need from us. Thanks again for everything. I really enjoy the Report – it is helping me grow my business and stay on top of things.”

– Independent FA.

“Great service from a great company!!” – FA from a National Brokerage Firm.

“Great report. You’ve become invaluable to me, thanks for everything…! – FA from a Boutique Investment Management Firm.

Subscriptions start at just $65 per month, billed quarterly, and with the option to cancel any time prior to the beginning of the next quarter, there’s simply no reason why you shouldn’t subscribe to The Sevens Report right now.

Begin your subscription to The Sevens Report right now by clicking this link and being redirected to our secure order form.

Finally, everything in business is a trade-off between capital and returns.

So, if you commit to an annual subscription, you get one month free, a savings of $65. To sign up for an annual subscription simply click here.

Best,

Tom

Tom Essaye

Editor, The Sevens Report