Earnings Disappointments Rekindle Economic Worries

What’s in Today’s Report:

- Earnings Disappointments From FDX and WGO Rekindle Economic Worries

- What the Strong Housing Starts Mean for Markets

- Bear Flattening Trend in Treasuries Underscores Hawkish Fed Expectations

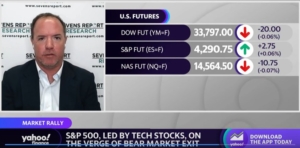

Stock futures are falling with global markets and yields are rising this morning after more hawkish central bank decisions overnight as focus turns to the BOE.

In Europe, monetary policy decisions were net hawkish as Norway’s central bank raised rates 50 bp vs. (E) 25 bp to 3.75% while the Swiss National Bank met estimates with a 25 bp hike to 1.75%. The rate hikes are pressuring global bond markets (yields higher) and weighing on sentiment, dragging equity markets lower.

Looking into today’s session, early focus will be on the Bank of England as a 25 bp hike to 4.75% in the benchmark policy rate is expected but there is risk of a 50 bp hike to 5.00% which would be another hawkish surprise for markets and likely result in rising yields and more pressure on overbought equity markets.

In the U.S. there are two economic reports to watch: Jobless Claims (E: 261K) and Existing Home Sales (E: 4.250M). A further rise in claims could bring into question whether or not the labor market is suddenly beginning to deteriorate meaningfully while strong housing data would warrant a hawkish reaction after the much better than expected Housing Starts print earlier this week.

From there, focus will turn to the Fed as Chair Powell continues his semi-annual Congressional testimony at 10:00 a.m. ET while Mester will speak around the same time (10:00 a.m. ET).

Finally, there is a 5-Yr TIPS auction at 1:00 p.m. ET that could offer insight to inflation expectations and move yields, but most of the market-moving news will likely hit before the lunch hour today.