What’s in Today’s Report:

- S&P 500 Tests “Better If” MMT Target

- Economic Data Takeaways (Goldilocks So Far)

- ECB Has More Work to Do on Inflation

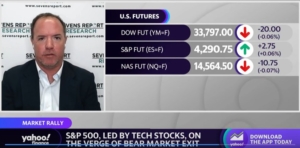

Stock futures are flat as yesterday’s rally is digested while global markets were mostly higher overnight thanks to continued optimism about AI focused investments and in-line inflation data in Europe.

ADBE shares were up as much as 4% in pre-market trading after strong earnings and AI-related guidance yesterday which is supporting mega-cap tech ahead of the open this morning.

The Narrow Core inflation reading within the Eurozone HICP (their CPI equivalent) fell from 5.6% to 5.3% y/y in May, meeting estimates and offering further confirmation that the global disinflation trend has resumed.

Today, there are no Fed officials scheduled to speak and just one economic report to watch: Consumer Sentiment (E: 60.5), but the consumer inflation expectations components within the release could move markets if they are meaningfully different from the previous release.

Finally, on a derivatives market note, today is a Quadruple Witching options expiration which means volumes will be elevated and volatility could potentially spike due to trader repositioning.