Stock Futures Waver With Bond Yields

Encouraging Inflation Data: Tom Essaye Quoted in Barron’s

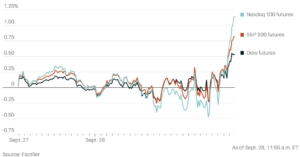

Stock Futures Waver With Bond Yields, Oil in Focus

U.S. stock futures wavered on Thursday, whipsawing after the release of economic data, though sentiment remained under pressure from a surge in bond yields and the price of oil amid ongoing concerns over interest rates and inflation.

“Encouraging inflation data from Europe was partially offset by ongoing government shutdown and labor strike worries,” said Tom Essaye, the founder of Sevens Report Research.

Also, click here to view the full Barron’s article on stock futures are bouncing published on September 28th, 2023. However, to see the Sevens Report’s full comments on the current market environment sign up here.

If you want research that comes with no long term commitment, yet provides independent, value added, plain English analysis of complex macro topics, then begin your Sevens Report subscription today by clicking here.

To strengthen your market knowledge take a free trial of The Sevens Report.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.