What the Near Government Shutdown Means for Markets

Government Shutdown Means for Markets: Start a free trial of The Sevens Report.

What’s in Today’s Report:

- What the Near Government Shutdown Means for Markets (Higher Yields)

- ISM Manufacturing Index Takeaways – Better Than Feared

Futures are little changed this morning. More evidence of cooling inflation was offset by global central bankers continuing to threaten more rate hikes.

Economically, Swiss CPI came in at 1.7% vs. (E) 1.8% y/y in September. The Core figure fell to 1.3% from 1.5% previously which was the latest report to confirm the ongoing trend of global disinflation.

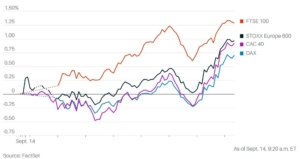

The RBA held policy rates steady at 4.10% overnight. But joined the growing chorus of ECB and Fed officials who have reiterated future hikes on the table. Global yields edged higher in early trade which is keeping a lid on equity futures this morning.

Looking into today’s session, we will receive data on Motor Vehicle Sales (E: 15.3 million). But more importantly, jobs week kicks off with today’s JOLTS release which is expected to show 8.9 million job openings.

An inline or modestly lower-than-expected JOLTS headline would be welcomed as it would help dial back some of the recent hawkish money flows. While an unexpected increase could spark a continued rise in yields, adding pressure to equity markets.

Finally, there is a 52-Wk Treasury Bill auction at 11:30 a.m. ET and while we typically do not monitor Bill auctions too closely, stocks came for sale and yields rose right at 11:30 a.m. yesterday. When the results of a 3-Month and 6-Month Bill auction hit the wires with higher yields than previous (hawkish). So if we see weak demand and higher yields in the late morning auction today, that could be a drag on equities and other risk assets.

Join hundreds of advisors from huge brokerage firms like Morgan Stanley, Merrill Lynch, Wells Fargo Advisors, Raymond James, and more! To start your quarterly subscription and see how The Sevens Report can help you grow your business, click here.