What’s in Today’s Report:

- Is the Increase in COVID Cases a Reason to De-Risk?

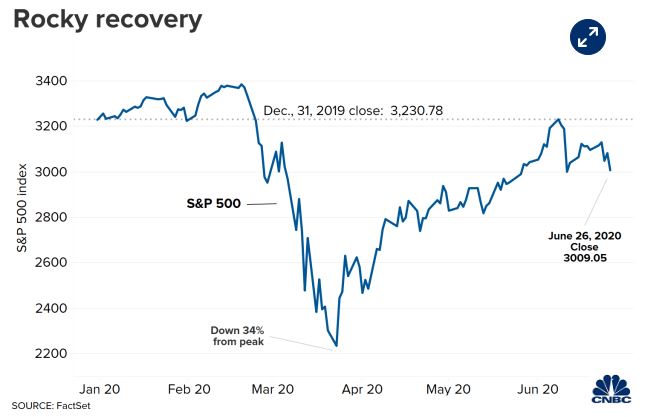

- Weekly Market Preview (Can the S&P 500 Hold 3000?)

- Weekly Economic Cheat Sheet (Jobs Report on Thursday)

Futures are slightly higher following a quiet weekend as markets attempt to bounce following Friday’s selloff.

Coronavirus cases continued to rise, with new U.S. cases topping 40k for Friday, Saturday and Sunday. More states (including California) are pausing re-openings, although none have re-imposed economic restrictions yet.

Economic data was sparse overnight as Euro Zone Economic Sentiment slightly missed expectations (75.7 vs. (E) 80).

Today there is just one economic report, Pending Home Sales (E: 11.3%) and one Fed speaker, Williams (3:00 p.m. ET) and neither should move markets.

Instead, focus will remain on the coronavirus and specifically whether more states pause, and potentially rollback, economic re-openings. Technically, the S&P 500 is sitting on support at 3,000, and if that’s broken, we could see a uptick in selling by programs and algos.